As the federal government shutdown stretches on, concern is mounting over what it could mean for construction activity across the U.S. economy. While a lengthy closure certainly creates uncertainty, Dodge Construction Network’s analysis suggests the overall impact would remain limited, though some market segments and regions could feel more pressure than others.

Limited Economic Fallout, Modest Construction Impact

Using Moody’s 12-week economic scenarios, Dodge economists estimate that a full-quarter shutdown could trim roughly 1.5 to 2 annualized percentage points off real GDP growth in Q4 2025. However, growth is projected to rebound by the end of 2026.

That slowdown translates to only a slight drag on overall construction starts. Federally funded projects represent a relatively small share of total activity and are more likely to be deferred than canceled. Private projects may see productivity challenges, but widespread disruption remains unlikely.

Housing Markets Feel the First Ripple

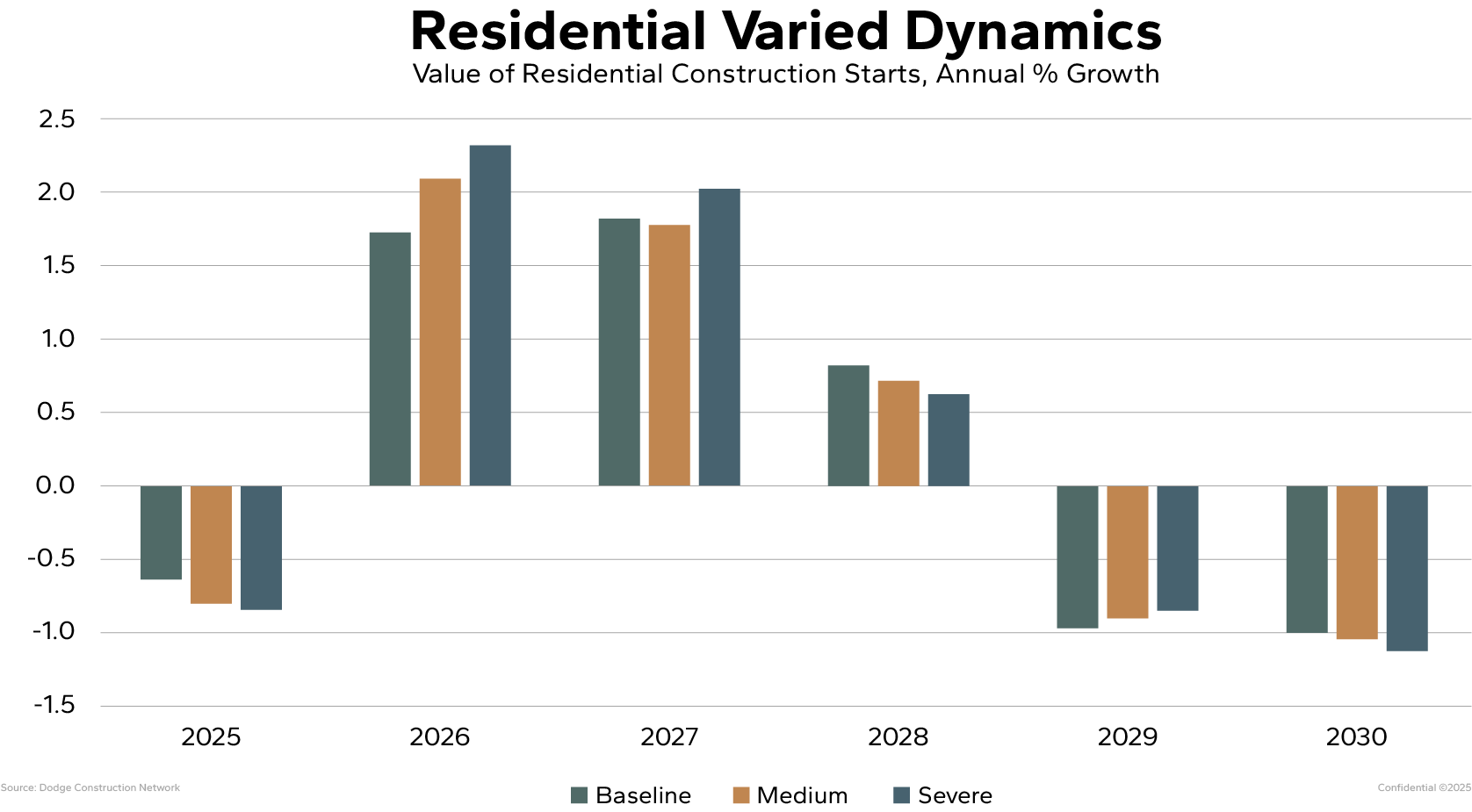

The residential sector, particularly single-family housing, is expected to react first. Dodge’s models show a mild dip in growth for 2025 as public housing projects stall, followed by a strong rebound in 2026 once activity resumes.

As shown in Chart 1, single-family construction tends to recover faster than multifamily due to its smaller project size and quicker planning cycles. These early fluctuations will ripple through the market as supply and demand adjust, creating a short-term “flip-flop” in growth patterns through the back half of 2026.

Commercial Construction Holds Steady

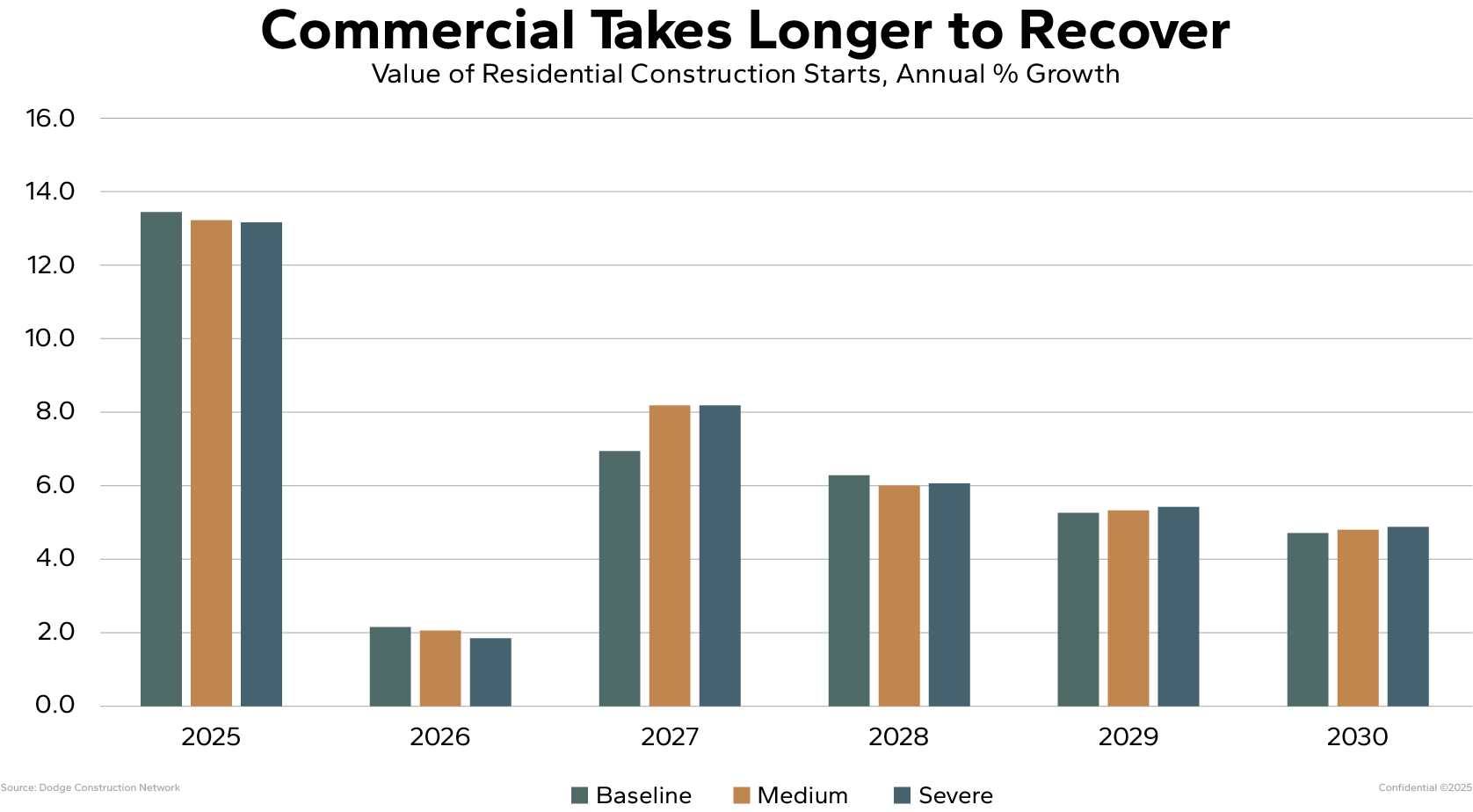

Privately financed commercial projects are less dependent on government funding, so the impact here is more indirect. Expect slightly slower momentum through late 2026 as a weaker economy tempers sentiment and investment appetite.

As Chart 2 illustrates, commercial construction growth softens temporarily before returning to steady expansion in 2027, supported by improved macro conditions and deferred demand coming back online.

Institutional Building Takes the Hardest Hit

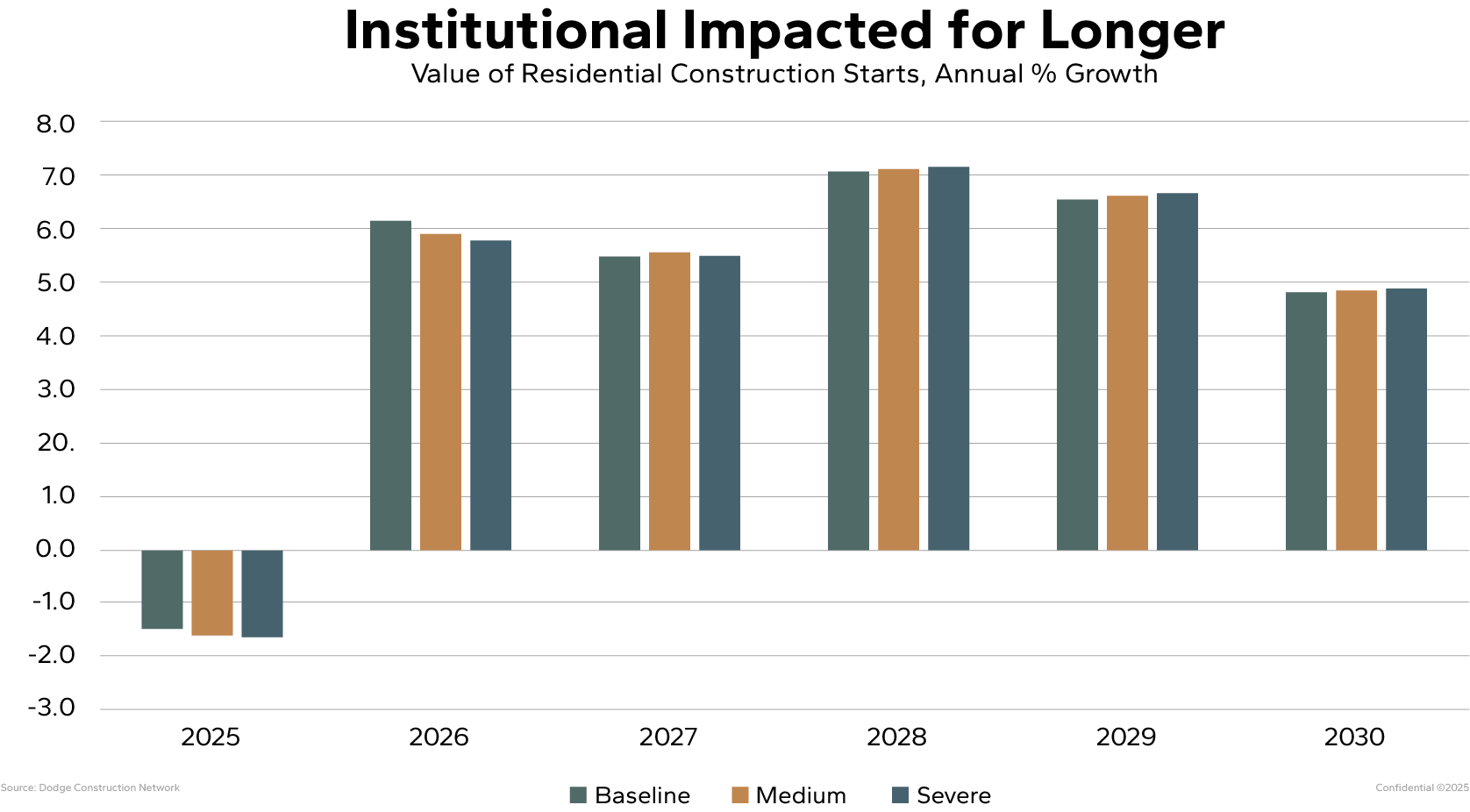

Institutional construction—particularly projects tied to education, healthcare, and public facilities—faces the steepest slowdown. With many of these projects reliant on federal funding or permitting, the shutdown delays early-stage progress and extends recovery timelines.

Chart 3 shows that while few institutional projects are expected to be abandoned outright, many will experience delays as planning teams and funding processes restart. Dodge anticipates a long, slow climb back, with institutional starts not fully recovering until the end of the five-year forecast horizon.

What It Means for Surety and Reinsurance

From a risk perspective, well-diversified surety and reinsurance providers should weather the storm. The main concern lies with those overexposed to government-backed projects, where new contract flow may weaken temporarily. Even so, losses are unlikely to exceed normal confidence ranges.

Bottom Line

For construction firms and financial partners alike, the message is clear: a protracted shutdown would create short-term friction, not long-term damage. Most deferred work should return to the pipeline once the government reopens, and broader economic fundamentals remain intact.

Importantly, Dodge’s current expectations are that negotiations to reopen the government will conclude by Thanksgiving, limiting the extent of disruption and allowing deferred activity to resume in the months that follow.

Read more insights from Dodge Construction Network’s economics team to stay informed on how policy and economic shifts shape construction’s future. Explore the Blog.