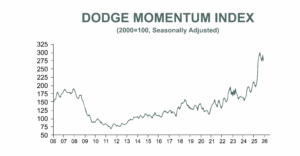

Nonresidential Planning Levels Off; Data Centers Continue to Support Strong Levels

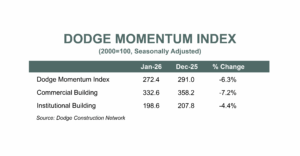

BOSTON, MA – February 6, 2026 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 6.3% in January to 272.7 (2000=100) from the downwardly revised December reading of 291.0. Over the month, commercial planning fell 7.2% and institutional planning momentum slowed by 4.4%.

“Planning momentum cooled in January across most commercial and institutional sectors,” said Sarah Martin, Associate Director of Forecasting at Dodge Construction Network. “Data center projects continue to lead the way, but after elevated activity in late 2025, most nonresidential sectors are now easing into a more sustainable growth pattern.”

On the commercial side, planning momentum slowed across all commercial sectors apart from retail stores. Within institutional planning, education, healthcare and public building planning slowed in January – while recreational and religious building projects continued to expand.

Year-over-year, the DMI was up 29% when compared to January 2025. The commercial segment was up 26% (+17% when data centers are removed) and the institutional segment was up 34% over the same period.

A total of 35 projects valued at $100 million or more entered planning throughout January. The largest commercial projects included the $500 million IEP Data Center (Project Hummingbird) in Monongahela Township, Pennsylvania, the $400 million Mountain Road Technology Park Data Center in Glen Allen, Virginia, and the $350 million Bitfarm Data Center in Nesquehoning, Pennsylvania. The largest institutional projects to enter planning were the $250 million USACE Barracks in Fort Hood, Texas, the $175 million UEPH Barracks at Joint Base Myer-Henderson in Arlington, Virginia, and the $148 million Eurofins Lancaster Biopharmaceutical Laboratory and Office Building in Lancaster, Pennsylvania.

The DMI is a monthly measure based on the three-month moving value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year to 18 months.