Written by: Eric Gaus, Dodge Chief Economist, and Sarah Martin, Associate Director of Forecasting

With the U.S. Census Bureau unable to release its construction spending and housing starts data throughout the government shutdown, Dodge Construction Network’s (Dodge) Economics team has developed independent estimates of what the Census likely would have reported over the past two months. While the government has re-opened, Dodge is assuming that Census’ data releases will remain delayed in the interim.

As a trusted and long-standing resource in the industry, Dodge is well positioned to provide these estimates. Dodge supplies some of the inputs used in the Census’ own construction spending calculations and has collected detailed construction starts data for decades. Our data collection methodology is nearly identical to Census in the case of single-family homes, while our broader dataset is directly tied to individually tracked construction projects. We monitor their progress from their earliest stages of planning until shovels break ground, at which point they are officially labeled a “construction start”, a term originally coined by Dodge.

While our data reporting categories usually differ from Census, these estimates follow Census’ conventions to ensure consistency and clarity during this period without official federal data.

Housing Starts

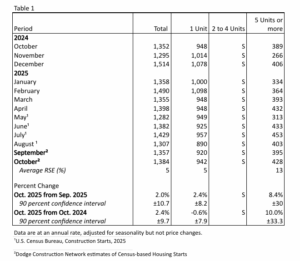

Dodge estimates that Census privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,384,000. This is 2.0 percent (±10.7 percent)* above Dodge’s September estimate of 1, 357,000 and is 2.4 percent (±9.7 percent)* above the October 2024 rate of 1,352,000.

Single-family housing starts in October were at a rate of 942,000; this is 2.4 percent (±8.2 percent)* above Dodge’s initial September figure of 920,000. The October rate for units in buildings with five units or more was 428,000.

Total Construction Spending

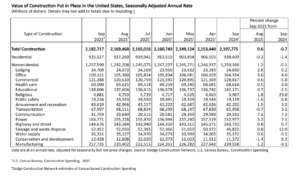

Dodge estimates that Census construction spending during September 2025 was estimated at a seasonally adjusted annual rate of $2,182.7 billion, 0.6 percent (±0.8 percent)* above the Census’ initial August estimate of $2,169.5 billion. The September figure is 0.7 percent (±1.5 percent) below the September 2024 estimate of $2,197.8 billion.

Dodge maintains a digitized database of historical construction starts dating back to 1967 and provides forecasts for construction starts, spending, and building stock across more than 20 construction categories. Our commercial construction starts data serves as a primary input for the U.S. Census Bureau’s Construction Put-in-Place (spending) calculations.

For more monthly insights on construction activity across key sectors, explore our latest industry reports.