Nonbuilding & data center starts drove 2025 growth.

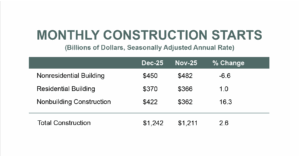

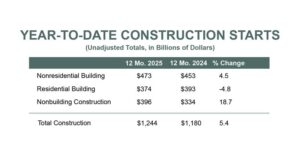

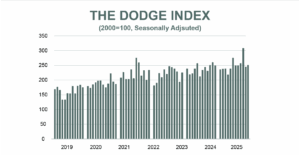

BOSTON, MA — January 23, 2026 — Total construction starts expanded 2.6% in December to a seasonally adjusted annual rate of $1.24 trillion, according to Dodge Construction Network. Nonresidential building starts fell by 6.6%, residential starts increased 1.0%, and nonbuilding starts grew 16.3% over the month. For the full year, total construction starts expanded 5.4%. Nonresidential starts were up 4.5%, residential starts were down 4.8% and nonbuilding starts were 18.7% higher when compared to 2024.

“Nonbuilding construction, alongside data centers, was the primary engine of growth in 2025, supporting a 5.4% expansion in the total dollar-value of starts,” stated Sarah Martin, Associate Director of Forecasting at Dodge Construction Network. “In square footage terms, however, building starts declined 4.7% alongside weaker residential, manufacturing, and institutional activity.”

Residential

Residential building starts rose by 1.0% in December to a seasonally adjusted annual rate of $370 billion. Single family starts decreased 4.5% m/m, while multifamily starts gained 10.2% m/m. In 2025, residential starts decreased 4.8% – with single family starts down 13.2% and multifamily starts up 13.1%.

The largest multifamily structures to break ground in December were the $502 million Launiu Ward Village Condominiums in Honolulu, Hawaii, the $500 million The Alloy Block Residential Tower (Phase 2) in Boerum Hill, New York and the $272 million SDSU Mission Valley Residential Building in San Diego, California.

Nonresidential

Nonresidential building starts decreased 6.6% in December to a seasonally adjusted annual rate of $450 billion. Commercial starts were up 9.8%, alongside growth in offices and data centers (+7.4% m/m), parking garages (+38.8% m/m), hotels (+74.4% m/m) and warehouses (+0.7% m/m). Meanwhile, retail starts (-12.2% m/m) posted a decline between November and December. Institutional starts declined 16.3%, driven by weaker education (-18.2% m/m) and miscellaneous institutional (-26.9% m/m) starts. This decline was partially offset by 7.9% m/m growth in healthcare facility starts. Manufacturing, meanwhile, pulled back 30.8% in December. In 2025, nonresidential starts improved 4.5%. Commercial and industrial starts expanded 10.9% and institutional starts receded 1.9% when compared to 2024.

The largest nonresidential building projects to break ground in December were the $1 billion Google Data Center (Phase 1) in West Memphis, Arkansas, the $750 million CyrusOne Data Center in Whitney, Texas and the $714 million SNA Data Center (Phase 2) in Cedar Rapids, Iowa.

Nonbuilding

Nonbuilding construction starts grew 16.3% in December to a seasonally adjusted annual rate of $422 billion. Highways and bridges (+85.2% m/m) and miscellaneous nonbuilding (+35.9% m/m) supported growth, while environmental public works (-26.9% m/m) and electric power/utilities (-9.0% m/m) faced declines.

The largest nonbuilding projects to break ground in December included the $3.5 billion Port Authority Midtown Bus Terminal (Phase 1) in New York, New York, the $1.6 billion Entergy Legend Power Station (754 MW) in Port Arthur, Texas and the $1.5 billion LAX Airport Roadway Improvements project in Los Angeles, California.

Regionally, total construction starts in December rose in the Northeast (+12.1% m/m), the South Central (+15.6% m/m), and the West (+6.9% m/m). Meanwhile, starts slowed down in the South Atlantic (-2.9% m/m) and the Midwest (-19.0% m/m)