New York and Washington DC top the list despite sizable declines in construction

NEW JERSEY—July 22, 2020—

The COVID-19 pandemic and resulting recession have wreaked havoc on U.S. building markets. According to Dodge Data & Analytics, commercial and multifamily starts were quite healthy during January and February but stalled as the pandemic hit the nation in March. For the first three months of 2020, U.S. multifamily and commercial building starts inched up 1% from the same period of 2019. The commercial and multifamily group is comprised of office buildings, stores, hotels, warehouses, commercial garages, and multifamily housing. Not included in this ranking are institutional building projects (such as educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works, and electric utilities/gas plants.

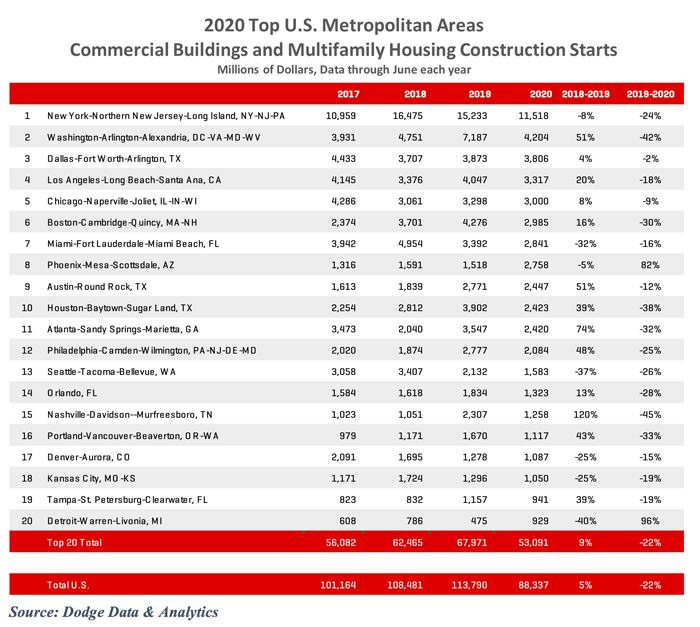

The full force of the pandemic bore down on U.S. construction starts in April as economic activity virtually shut down and local restrictions on construction took effect. Construction resumed in some areas in May allowing starts to post a mild gain over the month. Advances continued in June. However, the damage to commercial and multifamily construction during the first half of the year was palpable. Starts plunged 22% below the first half of 2019, with only warehouse construction posting a very small gain. Commercial and multifamily construction starts in the top 20 metropolitan areas posted a similar drop of 22% through the first six months of 2020.

In the top 10 metro areas, commercial and multifamily starts slid 21% and only one metro area posted an increase. The New York metro area held on to its top spot, despite falling 24% below year-ago levels to $11.5 billion. Washington DC held to second place even though commercial and multifamily construction starts fell 42% to $4.2 billion. The Dallas TX metro area rounded out the top three, with commercial and multifamily activity dropping just 2% to $3.8 billion. The remaining markets in the top 10 were Los Angeles CA (-18% to $3.3 billion), Chicago IL (-9% to $3.0 billion), Boston MA (-31% to $3.0 billion), Miami FL (-16% to $2.8 billion), Phoenix AZ (+82% to $2.8 billion), Austin TX (-12% to $2.4 billion), and Houston TX (-38% to $2.4 billion).

Among the second-tier (ranked 11-20) metro areas, commercial and multifamily starts plummeted 25% with just one metro area posting an increase. The second tier metros include Atlanta GA (-32% to $2.4 billion), Philadelphia PA (-25% to $2.1 billion), Seattle WA (-26% to $1.6 billion), Orlando FL (-28% to $1.3 billion), Nashville TN (-45% to $1.3 billion), Portland OR (-33% to $1.1 billion), Denver CO (-15% to $1.1 billion), Kansas City MO (-20% to $1.1 billion), Tampa FL (-19% to $941 million), and Detroit MI (+96% to $929 million).

“The COVID-19 pandemic and recession have devastated most local construction markets,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Across the board, building projects have been halted or delayed with virtually no sector immune from damage. Construction starts have begun to increase from their April lows and there is cautious optimism that as the year progresses construction markets around the country will begin a modest recovery. However, the recent acceleration of COVID-19 cases in the South and West as well as the upcoming expiration of expanded unemployment insurance benefits (from the CARES Act) puts the recovery at significant risk and could undermine the construction sector’s ability to grow.”

During the first half of 2020, commercial and multifamily starts in New York NY fell 24% to $11.5 billion relative to the first six months of 2019. Commercial starts were 18% lower, a relatively sanguine decline given the almost two-month ban on nonessential construction in the city. However, the modest impact on construction was due to the start of two very large office projects that broke ground in February — the $1.3 billion Two Manhattan West office building and the $760 million Disney/ABC Headquarters. Removing those two buildings would have resulted in a 50% decline in commercial starts during the first half of the year. Multifamily starts dropped 29% in the first six months of the year. The largest multifamily projects to get underway were the $420 million Hunter’s Point South mixed-use project in Long Island City NY and the $260 million 451 10th Ave. apartment building.

In Washington DC, commercial and multifamily starts fell 42% to $4.2 billion during the first half of 2020 relative to the same period of 2019. Multifamily starts lost 27% over this year’s first six months. The largest multifamily projects were the $150 million Ripley II–Solaire Apartments in Silver Spring MD and the $150 million Storey Park mixed-use building in Washington DC. Commercial starts fell 50% during the first half of the year, with the only gain coming from the hotel sector, which posted a $67 million gain (38%) over 2019. The largest commercial project to break ground in the Washington DC metro was the $306 million Aligned Energy Data Center (Building II) in Ashburn VA. Amazon Inc. also broke ground on two buildings associated with the HQ2 project in Arlington VA, each totaling $240 million.

Commercial and multifamily starts in the Dallas TX metro area hit $3.8 billion in the first six months of the year, a decline of just 2% from 2019’s first half. Multifamily starts gained 8%, one of the few top metros to post a gain in this market. The largest multifamily projects to get started in the first six months were the $75 million Novel Turtle Creek residential tower in Dallas TX and the $65 million Shannon Creek apartments in Burleson TX. Commercial starts fell 6% in this year’s first six months, with declines in hotel, office, and parking structures partly offset by gains in retail and warehouse starts. The largest commercial projects were the $136 million Epic Deep Ellum (building II) in Dallas TX and the $100 million American Airlines flight kitchen (food service is considered part of the retail sector).

Los Angeles CA commercial and multifamily starts dropped 18% during the first six months of 2020 to $3.3 billion. Commercial starts fell 9% on a year-to-date basis, with strength coming from the office market which posted a large gain. That gain, however, was not enough to offset declines elsewhere in the commercial space. The largest commercial projects to break ground during the first half of 2020 were the $355 million Fig + Pico AC Marriott/Hilton hotel in Los Angeles and the $240 million first phase of the Iceberg Tower office project in Burbank. Multifamily starts were down 26% over the same time period. The largest multifamily projects to start during the first half of the year were the $95 million 3535 W 8th St. mixed-use project in Los Angeles and the $93 million First Point residential building in Santa Ana CA.

Commercial and multifamily starts in Chicago IL were 9% lower on a year-to-date basis through June, reaching $3.0 billion. Commercial starts increased 24% on the strength of a near-doubling in office starts as well as an increase in hotel construction that more than offset steep declines in retail, warehouses, and parking structures. The two largest commercial projects to get underway in the first six months of 2020 were the $476 million BMO Office Tower and the $360 million Wolf Point South Tower B, both in Chicago. Multifamily starts in 2020 were 44% lower than in the first half of 2019. The largest multifamily structures to get started were the $150 million 354 N Union apartments in Chicago and the $100 million Maple Street Lofts in Mount Prospect.

During the first half of 2020, commercial and multifamily starts in Boston MA declined by 30% to $3.0 billion. Multifamily starts dropped 10% on a year-to-date basis. The largest multifamily projects to get underway were the $150 million Cambridge Crossing (Parcel I) complex in Cambridge MA and the $115 million Woburn Avalon Bay project in Woburn MA. Starts on the commercial side fell 43% with all commercial sectors except warehouses posting a decline. The largest commercial projects were the $450 million first phase of the South Station Office Tower and the $250 million Seaport Square/400 Summer Street office building, both in Boston.

Miami FL commercial and multifamily starts fell 16% year-to-date through June to $2.8 billion. Multifamily construction was 11% lower over the same time period. The largest multifamily projects to break ground in the first six months were the $249 million Downtown 5th Luxury Apartments in Miami and the $115 million Miami Urban Village apartments in Homestead. On the commercial side, starts were 22% lower, with warehouse starts the only sector to post a gain year-to-date. The largest commercial projects were the $80 million Pier Sixty-Six Hotel and a $67 million Home Depot distribution center.

Commercial and multifamily construction starts in Phoenix AZ bucked the national trend posting a sizeable 82% increase to $2.8 billion during the first half of 2020 relative to the same time frame in 2019. The increase was fueled by the start of some sizeable projects. Multifamily starts rose sharply, jumping 85%. The largest multifamily projects to get started were the $300 million Pier 202 mixed-use building and the $125 million Adeline Residences at Collier Center, both in Tempe. Commercial starts meanwhile rose 79%. The largest commercial projects were the $200 million 100 Mill Ave office development and the $115 million Park 303 warehouse building.

Year-to-date commercial and multifamily construction starts in Austin TX fell 12% through June to $2.4 billion. Multifamily starts increased 21% in the first half of 2020, boosted by the $150 million 44 East Condo Tower and the $120 million Hanover Republic Square apartment building. Commercial starts fell 28% during the first six months despite sizeable gains in warehouse and hotel starts. The largest commercial projects were the $300 million Project Charm Amazon distribution center and the $89 million Capitol Complex Office Building.

Completing the top 10 for commercial and multifamily construction starts was Houston TX where starts were 38% lower at $2.4 billion through the first six months of 2020. Multifamily starts posted a 38% decline through June. The largest multifamily projects to break ground were the $217 million Hanover Square & Bayou Apartments as well as the $70 million Boone Manor Apartments. Commercial starts also fell 38% during the first six months of the year, with only parking structures posting a gain. The largest commercial projects to start were the $100 million Hewlett Packard Enterprises Campus @ Cityplace and the $58 million Empire West Business Park.

###

About Dodge Construction Network Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com

Media Contact :

Cailey Henderson | 104 West Partners | cailey.henderson@104west.com