HAMILTON, NJ — November 17, 2022 —

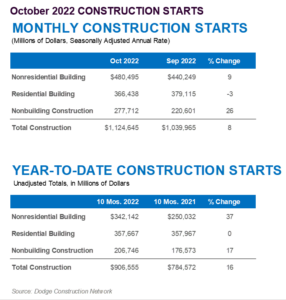

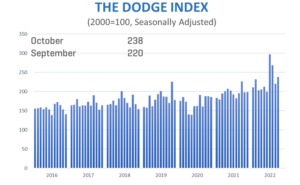

Total construction starts rose 8% in October to a seasonally adjusted annual rate of $1.12 trillion, according to Dodge Construction Network. In October, nonresidential building starts gained 9%, and nonbuilding starts rose 26%; however, residential starts fell by 3%.

Year-to-date, total construction was 16% higher in the first ten months of 2022 compared to the same period of 2021. Nonresidential building starts rose 37% over the year, residential starts remained flat, and nonbuilding starts were up 17%.

“October’s gain in construction starts is a further sign that the construction sector continues to weather the storm of higher interest rates,” said Richard Branch, chief economist for Dodge Construction Network. “While the residential sector is feeling the pain, the nonresidential building and infrastructure sectors are hitting their stride. Some weakness is to be expected as the Federal Reserve continues its battle with inflation; however, the damage should be isolated to a few verticals and not as widespread as what the industry witnessed during the Great Recession.”

Nonbuilding construction starts rose 26% in October to a seasonally adjusted annual rate of $277.7 billion. Highway and bridge starts rose 57%, while utility/gas plants increased 19%, and environmental public works were 13% higher. This growth is tempered as miscellaneous nonbuilding starts fell 20% in the month. Through the ten months of the year, total nonbuilding starts were 17% higher than in 2021. Highway and bridge starts were 25% higher, environmental public works were 14% higher, and miscellaneous nonbuilding starts increased 17% on a year-to-date basis. Utility/gas plant starts were flat.

The largest nonbuilding projects to break ground in October were the $576 million TX DOT Interstate Highway 820 reconstruction project in Fort Worth, TX, the $548 million TX DOT Interstate Highway 35 widening project in Austin, TX, and the $364 million repaving project in Honolulu, HI.

Nonresidential building starts rose 9% in October to a seasonally adjusted annual rate of $480.5 billion. During the month, commercial starts rose 19%, led by office and hotel projects. Institutional starts rose 8% due to a surge in education projects, while manufacturing starts fell by 5%. Through the first ten months of 2022, nonresidential building starts were 37% higher than the first ten months of 2021. Commercial starts grew 23%, and institutional starts rose 21%. Manufacturing starts were 157% higher on a year-to-date basis.

The largest nonresidential building projects to break ground in October were the $3.2 billion Texas Industries chip fabrication plant (building 1) in Sherman, TX, the $2.0 billion General Motors Orion EV plant in Orion Township, MI, and the $1 billion Gevo Net-Zero 1 hydrocarbon plant in Lake Preston, SD.

Residential building starts fell 3% in October to a seasonally adjusted annual rate of $366.4 billion. Single family starts lost 3%, while multifamily starts dropped 4%. Through the first ten months of 2022, residential starts were flat when compared to the same time frame in 2021. Multifamily starts were up 26%, while single family housing slipped 10%.

The largest multifamily structures to break ground in October were the $564 million Long Island City Center II in Long Island City, NY, the $450 million Waldorf Astoria residences and hotel in Miami, FL, and the $167 million Modera McGavock mixed-use building in Nashville, TN.

Regionally, total construction starts in October rose in the Midwest and South Atlantic regions, but fell in the South Central and West.

Watch Chief Economist Richard Branch discuss October Constructions Starts.

###

About Dodge Construction Network Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com

Media Contact :

Cailey Henderson | 104 West Partners | cailey.henderson@104west.com