Three large projects break ground to push starts higher, weak activity elsewhere

HAMILTON, New Jersey — November 17, 2021 —

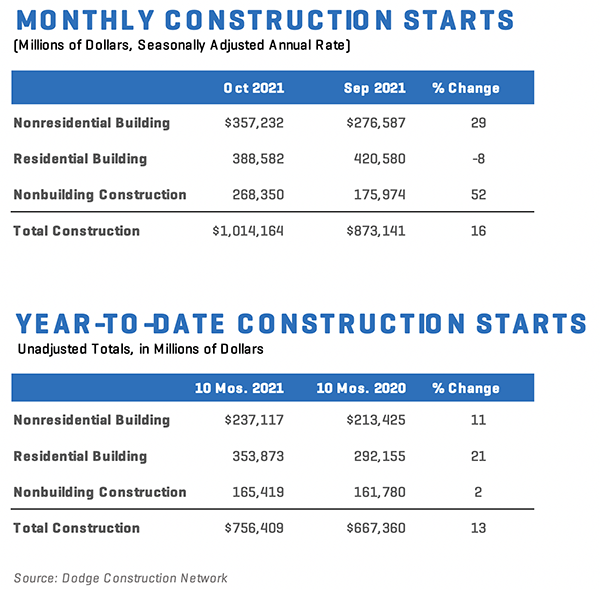

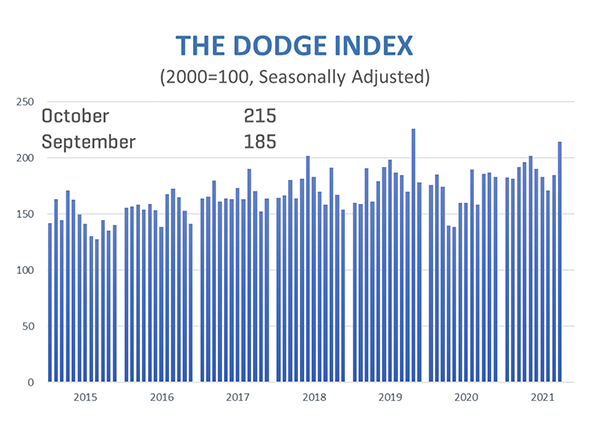

Total construction starts pushed 16% higher in October to a seasonally adjusted annual rate of $1.01 trillion, according to Dodge Construction Network. Nonresidential building starts gained 29% and nonbuilding moved 52% higher in October, while residential starts lost 8%. The month’s large gains resulted from the start of three large projects: two massive manufacturing plants and an LNG export facility. Without these projects, total construction starts would have fallen 6% in October.

“Economic growth has resumed following the third quarter’s Delta-led slowdown. However, the construction sector’s grip on growth remains tenuous,” stated Richard Branch, Chief Economist for Dodge Construction Network. “Long term, construction starts should improve, fed by an increase of nonresidential building projects in the planning pipeline and the recent passage of the infrastructure bill. Both will provide meaningful support and growth to construction in the year to come. This expectation, however, must be tempered by the significant challenges facing the industry: high prices, shortages of key materials, and the continued scarcity of skilled labor. While healing from the pandemic continues, there’s still a long road back to full recovery.”

Below is the breakdown for construction starts:

- Nonbuilding construction starts rose 52% in October to a seasonally adjusted annual rate of $268.4 billion. This increase was solely due to the start of an $8.5 billion LNG export facility, which lifted the utility/gas plant category significantly. However, even without this project, the utility/gas plant category would still have registered a strong gain because of the very low level of activity in September. The public works side of nonbuilding construction was more dismal. Miscellaneous nonbuilding starts fell 43% over the month, and highway/bridge and environmental public works starts lost 14% and 16% respectively. Year-to-date, total nonbuilding starts were 2% higher through October. Environmental public works were 23% higher, and utility/gas plant starts are up 14%. At the same time, highway and bridge starts were 7% lower, miscellaneous nonbuilding fell 13%, and utility/gas plant starts fell 10% during the first ten months of the year.For the 12 months ending in October 2021, total nonbuilding starts were 1% lower than the 12 months ending in October 2020. Environmental public works starts were 22% higher but highway and bridge starts were down 7%. Utility and gas plant starts were down 10% and miscellaneous nonbuilding starts were 7% lower on a 12-month rolling basis.

The largest nonbuilding projects to break ground in October were the $8.5 billion Venture Global LNG Export facility in Plaquemines Parish, LA, the $484 million Moses-Adirondack SMART PATH 1&2 Lines rebuild project in the Lewis and St. Lawrence counties of New York, and the $454 million RiverRenew tunnel in Alexandria, VA. - Nonresidential building starts shot 29% higher in October to a seasonally adjusted annual rate of $357.2 billion. The catalyst for the increase was a large gain in the manufacturing sector as two very large projects kicked off. If not for these projects, total nonresidential building starts would have been down 3% over the month. In October, commercial starts lost 4%, with only hotels posting a gain. Institutional starts gained 4%, with all categories rising. In the first ten months of 2021, nonresidential building starts were 11% higher. Commercial starts increased 9%, manufacturing starts were 94% higher (39% without the large projects this month), and institutional starts were up 3%.For the 12 months ending in October 2021, nonresidential building starts were 4% higher than in the 12 months ending in October 2020. Both commercial and institutional starts were up 2%, and manufacturing starts moved 24% higher in the 12 months ending October 2021.

The largest nonresidential building projects to break ground in October were the $6.0 billion first phase of the Taiwan Semiconductor plant in Phoenix, AZ, the $1.3 billion Methanex Methanol plant in Geismar, LA, and the $550 million second phase of the Loews Hotel and Convention Center in Arlington, TX. - Residential building starts fell 8% in October to a seasonally adjusted annual rate of $388.6 billion. Single family starts gained less than one percent, while multifamily starts fell 24%. Through the first ten months of 2021, residential starts were 21% higher than in the same period one year ago. Single family starts gained 22% and multifamily starts grew 10%.For the 12 months ending in October 2021, total residential starts were 20% higher than the 12 months ending in October 2020. Single family starts gained 23% and multifamily starts were up 11% on a 12-month sum basis.

The largest multifamily structures to break ground in October were the $286 million first phase of the Archer Towers in Jamacia, NY, the $120 million residential portion of a mixed-use building on 3rd Ave in Bronx, NY, and the $106 million Su Development Yesler Terrace Housing Block in Seattle, WA. - Regionally, total construction starts improved in the South Central and West regions, while slipping in the Northeast, Midwest, and South Atlantic regions.

OCTOBER 2021 CONSTRUCTION STARTS

###

About Dodge Construction Network Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com

Media Contact :

Cailey Henderson | 104 West Partners | cailey.henderson@104west.com