by Ralph Flores, Economist at Dodge Construction Network

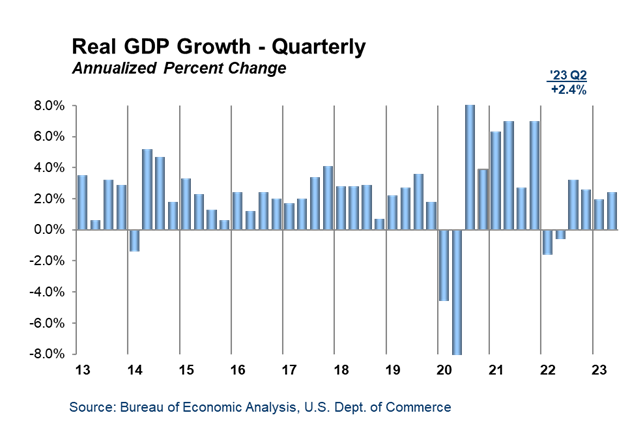

The Gross Domestic Product (GDP) report for the second quarter of 2023, released by the Bureau of Economic Analysis (BEA), shows that the economy grew at an annualized rate of 2.4 %, surpassing the first quarter’s 2.0 % growth. This growth was driven by consumer spending, rebounding business investments, and increased state and local government spending. The release aligns with our overall projections, reaffirming our confidence in the U.S. economy’s resilience against a technical recession over the next year.

Consumer spending continued to play a pivotal role in sustaining growth. Although there was a slight slowdown from the previous quarter, consumer spending grew at 1.6 %, reflecting increased spending on services, like travel, dining, and entertainment, as well as durable goods. Additionally, businesses showed renewed confidence as they increased their investments in the second quarter, bouncing back from a previous slump. This boost in business investment was seen in higher spending on equipment and nonresidential fixed investments. Moreover, the ongoing federal infrastructure investments further contributed to economic activity in the nonresidential (particularly manufacturing) and nonbuilding sectors.

One notable aspect of the GDP report is that inflationary pressures eased during the second quarter. The price index for gross domestic purchases rose at a slower rate of 1.9 %, compared to 3.8 % in the previous quarter. This slowdown in inflation is good news for the average American as it helps them maintain their purchasing power. It also bolsters the likelihood of the Fed achieving a soft landing with their interest hikes. However, there are some potential headwinds on the horizon. Higher borrowing costs from banks tightening credit along with the gradual depletion of excess savings, have been impacting residential fixed investment, leading to continued declines in the second quarter. These elements are starting to seep into other sectors, including commercial, and will contribute to a slowdown in starts activity in the second half of the year.