by Arsene Aka, Senior Economist at Dodge Construction Network

Wages may be softening and employment normalizing, according to data released by the Bureau of Labor Statistics (BLS) on September 1. Indeed, total nonfarm payrolls grew by a seasonally adjusted 187,000 in August, which is lower than the average monthly gains of 204,000 and 271,000 posted over the prior 6 and 12 months, respectively. The average hourly earnings were up 4.3% year-on-year (y/y) last month, easing from the growth of 4.4% y/y posted in both July and June. On the other hand, the unemployment rate rose from 3.5% in July to 3.8% a month later, reflecting an increase in the labor force participation rate.

The deceleration in nonfarm employment from the average monthly gains over the prior 6 and 12 months is not surprising: the rapid tightening in monetary policy since early 2022 has led to cooling inflation and labor markets. In addition, last month’s employment report has also been impacted by the ongoing Hollywood workers strike, which began in mid-July, and the Yellow trucking layoffs.

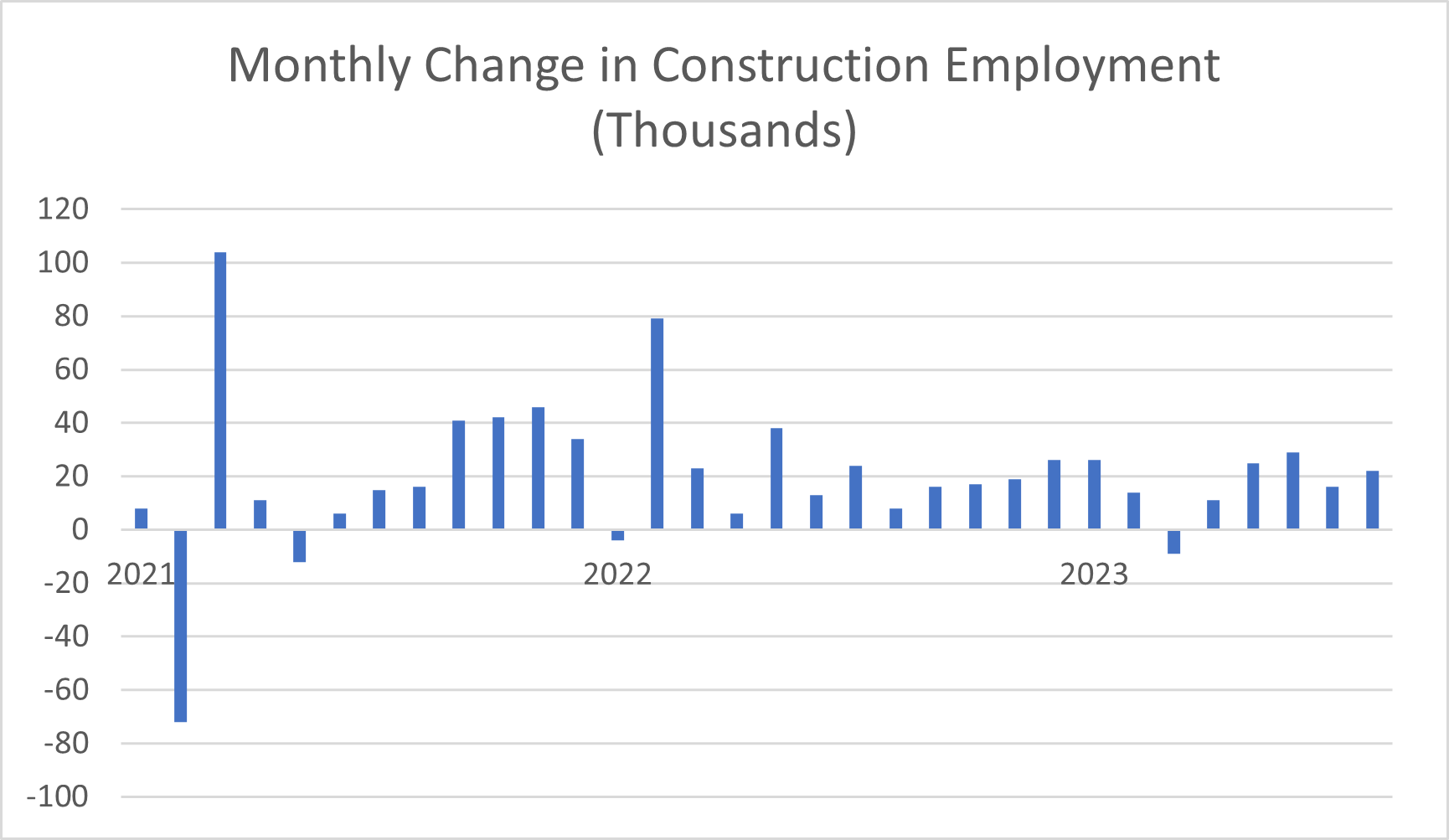

Meanwhile, construction employment continues to be robust, rising by 22,000 in August, which is higher than the gain (16,000) posted a month earlier and the increase of 17,000 recorded in the prior 12 months. Nonresidential construction employment accounted for most of the growth, increasing by 21,000 positions over the month, with positive advances posted in all subcategories. Indeed, nonresidential specialty trade added 12,100 jobs while nonresidential building saw 1,800 new jobs and heavy and civil engineering added 7,100 jobs.

On the other hand, residential construction employment grew by only 1,400 between July and August, driven by growth in residential building construction employment. The unemployment rate in construction remained flat during that same period, at 3.9%.

The tightness in construction labor market is expected to continue over the next several months, due to several factors: the Fed’s restrictive monetary policy (i.e., elevated interest rates) is expected to continue this year and early next year. In addition, the shortage of skilled construction workers is expected to worsen as funds from federal legislations (such as the CHIPS Act, Inflation Reduction Act and the Infrastructure Investment and Jobs Act) continue to flow into the construction industry: quasi-public megaprojects are expected to lead to an outsized demand for these workers. Finally, employers in the construction industry have announced 4,394 job cuts year to date through August, more than double the 1,449 announced during the same period last year. More job cuts could be announced in coming months.

Because of tight labor markets, construction wages are expected to remain strong in 2023/24. In August, the average hourly earnings in the construction sector were up 5.2% y/y, almost a full percentage point above the pace for the overall economy (4.3%).