by Arsene Aka, Senior Economist at Dodge Construction Network

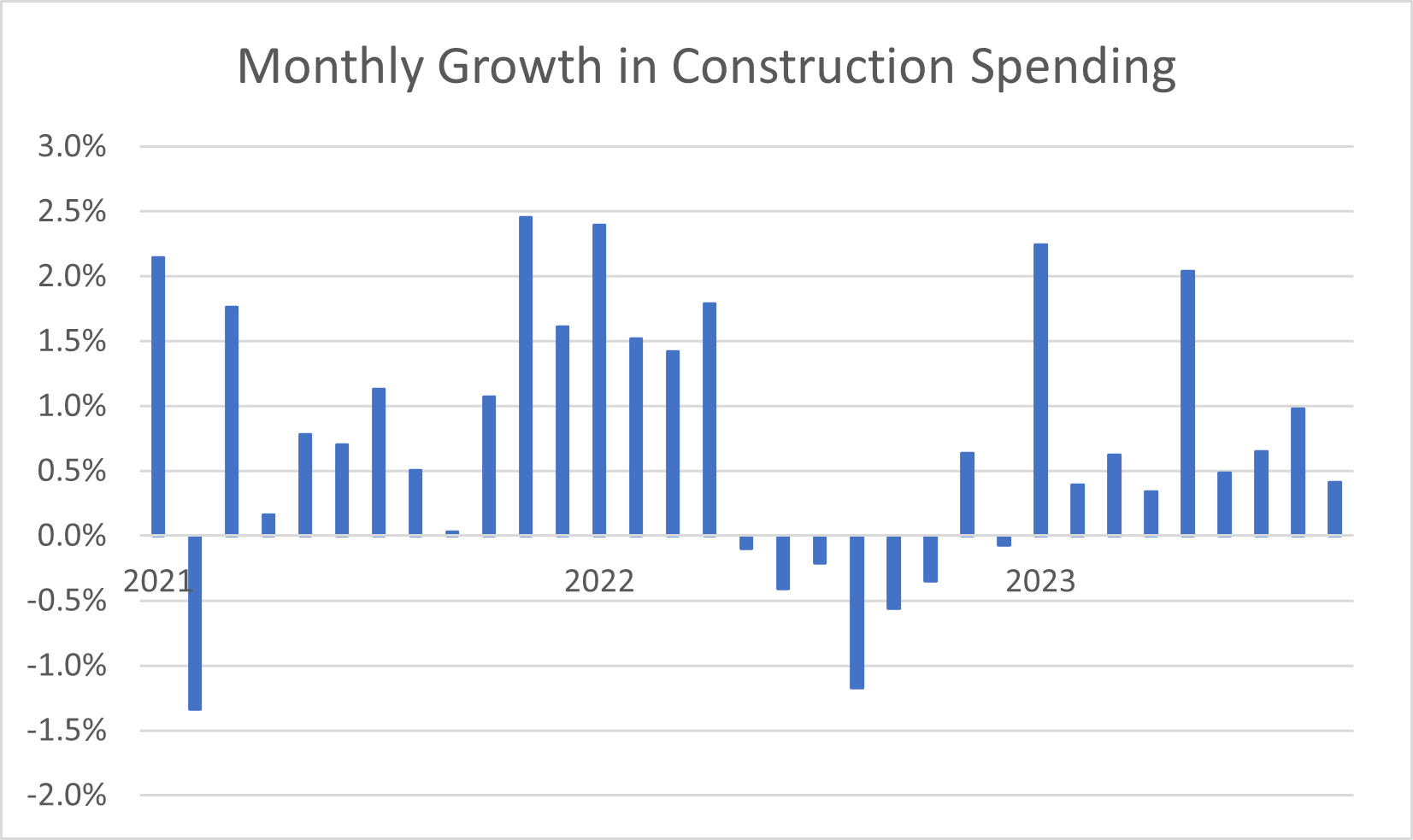

Data released by the Commerce Department (Census Bureau) shows that construction spending, which measures work currently underway, continues to rise. Construction outlays were up 0.4% in September to a seasonally adjusted annualized rate of $1.997 trillion, marking the ninth consecutive month of increase. The August data was revised significantly higher and shows construction spending increasing 1.0% instead of 0.5%. On a year-on-year basis, growth in construction spending stood at 8.7% in September, up from 7.6% in the previous month.

Accounting for 62% of the change in overall expenditure, spending on new single-family construction projects soared 1.3%, reflecting the fact that single family starts hit a bottom in January and have risen in seven of the nine months of 2023. Continued shortage of existing homes on the market and various builders’ incentives in the high mortgage rate environment have also helped to boost spending on new single-family construction projects. Meanwhile, the multifamily segment declined in September. As a result, the value of private residential construction put in place during the month rose by 0.6%.

Spending on private nonresidential construction advanced by 0.1% to an annualized rate of $684 billion, but growth was not broad based across nonresidential categories. While categories such as commercial, education, and amusement enjoyed a robust increase in outlays, spending on manufacturing, lodging, transportation, religious construction, and healthcare fell in September. The decline in manufacturing outlays is not surprising given the very strong increases posted for most months in 2023.

Finally, spending on public construction projects rose 0.4% to a seasonally adjusted annualized rate of $441 billion in September, after jumping 0.9% a month earlier. While spending on educational construction surged by 1.9%, spending on highway and streets, sewers and water construction edged down. Compared with a year earlier, public construction spending was 15.5% higher.

The Commerce Department’s construction spending report, which is highly correlated with Dodge Construction Network’s total and nonresidential starts, shows that builders are being put to work, as demand for homes remains high and public funds continue to flow into the construction sector. Going forward, construction spending is likely to ease in 2024, as construction starts are pulling back and expected to be flat for whole of 2023.

Data Source: https://www.census.gov/construction/c30/current/index.html