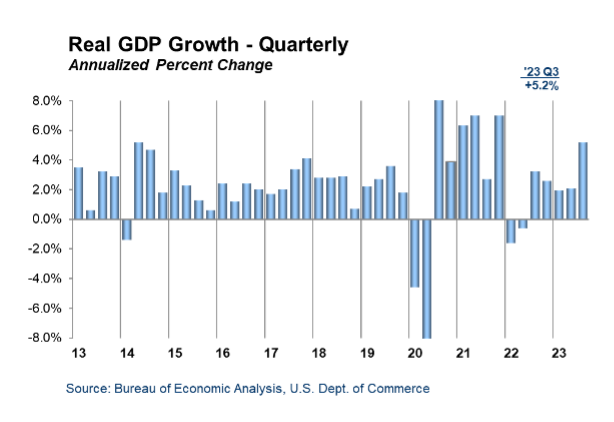

The “second” estimate for the third quarter of 2023, recently published by the Bureau of Economic Analysis (BEA), reinforces the robust performance of the U.S. economy. Real gross domestic product (GDP) exhibited an increase, growing at an annual rate of 5.2%, surpassing the earlier “advance” estimate of 4.9%, and exceeding the 2.1% growth recorded in the second quarter.

The increase in the real GDP estimate is mainly due to positive revisions in nonresidential fixed investment and state and local government spending, although these were partially offset by a slight downward revision to consumer spending. The overall growth in real GDP, compared to the previous quarter, is supported by increased consumer spending, private inventory investment, exports, state and local government spending, federal government spending, residential fixed investment, and nonresidential fixed investment. Additionally, imports, which are subtracted in GDP calculations, experienced a downward revision.

Inflationary pressures persist, as the price index for gross domestic purchases showed a sustained 3.0% increase. The personal consumption expenditures (PCE) price index is estimated to have risen 2.8%, with a minor downward adjustment of 0.1 percentage point since the first GDP estimate. The core PCE price index, excluding food and energy prices, grew 2.3%, driven by an uptick in the cost of consumer goods and services. The Federal Reserve’s key inflation rate the rate did not experience a significant increase or decrease, suggesting that inflation is not accelerating rapidly. However, to curb inflation, the Federal Reserve may need to keep interest rates higher for a more extended period than initially anticipated.

The revised data highlights the resilience and strength of the U.S. economy in the third quarter. While positive economic indicators are widespread, challenges such as inflation and potential shifts in monetary policy warrant continued attention. The current trajectory aligns with our forecast, which anticipates a slower economic growth in the fourth quarter. The dip in planning activity witnessed in the first half of the year, coupled with a deceleration in construction starts, indicates that construction pace over the next 6-9 months may slow down, implying a potential downturn in commercial activity due to stricter lending standards and rising interest rates. Despite these challenges, both institutional and nonbuilding activities are anticipated to stay resilient, buoyed by public funding and their relative insensitivity to fluctuations in interest rates.