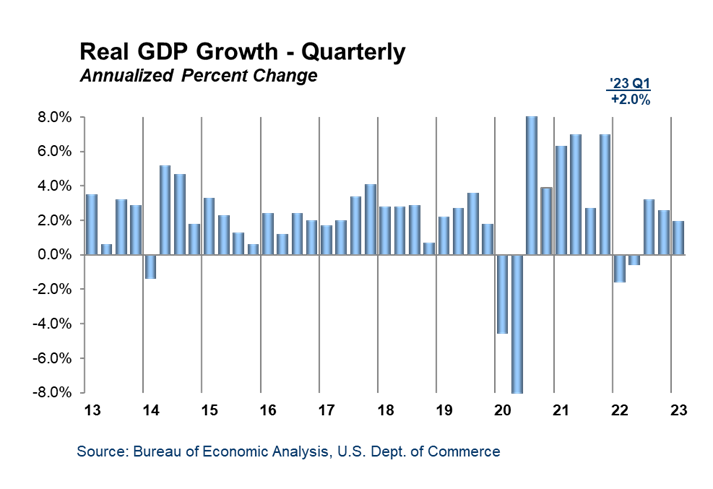

The Bureau of Economic Analysis (BEA) has released the final estimate for the United States’ Gross Domestic Product (GDP), shedding light on the resilience of the U.S. economy despite challenges such as the Federal Reserve’s interest-rate hikes. The latest figures demonstrate new growth, with real GDP expanding at an annual rate of 2.0 percent in the first quarter of 2023, surpassing the previous estimate of 1.3 percent.

The positive shift in GDP was driven by upward revisions in consumer spending and exports. These upward revisions indicate that households were willing to spend on goods and services, while businesses managed to successfully sell more products to other countries. Furthermore, imports, which are subtracted in the calculation of GDP, were revised down. This implies growth in the consumption of goods and services that were domestically produced, which contributes to the overall strength and health of the economy. While federal government spending and nonresidential fixed investment— which includes the construction and renovation of office buildings, retail spaces, warehouses, and other commercial properties— experienced downward revisions, it is crucial to note that the overall growth trajectory of the economy remains positive.

The revised estimate for U.S. GDP growth in the first quarter reinforces that the U.S. is a long way off from recession despite significantly tighter monetary policy and further expected tightening from the Fed. However, it is important to note that higher interest rates over time can have implications for future construction activity, particularly in the residential and commercial sectors. Considering the information provided by the Dodge Momentum Index (DMI), which highlights the recent trends in planning activity, we observe a dip in May due to sustained weakness in commercial planning. This dip highlights the ongoing downward trajectory in the DMI observed in previous months. It is expected that the sustained elevation in the federal funds rate and tighter lending standards will likely constrain growth in the DMI during the latter half of 2023. Despite these factors, the overall outlook remains mildly positive, primarily due to the positive impacts of the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act, and IRA. These legislative initiatives are creating favorable conditions in the construction industry and the broader economy, with a particular emphasis on benefiting the manufacturing and nonbuilding sectors.