2020 State of the Industry

The last decade of growth in construction is reaching a turning point. How much will it change?

For the last 10 years, the construction industry has seen a remarkable line of expansion, with every year seeming to top the previous year. Only the shortage of skilled labor has taken any of the steam off the growth.

But going into the next decade, uncertainty is creeping into the market, and not just on the economics side. Increasing sophistication of projects, improved technologies and more demanding clients are all forcing everyone in the industry to rethink and reevaluate their processes.

This year’s State of the Industry Report includes five industry professionals who are struggling with that change both for the good and worse of it. Now is the time to act as we move forward.

The Tipping Point

A decade of expansion is nearing a point when the construction economy could change

By Richard Branch, Chief Economist, Dodge Data & Analytics

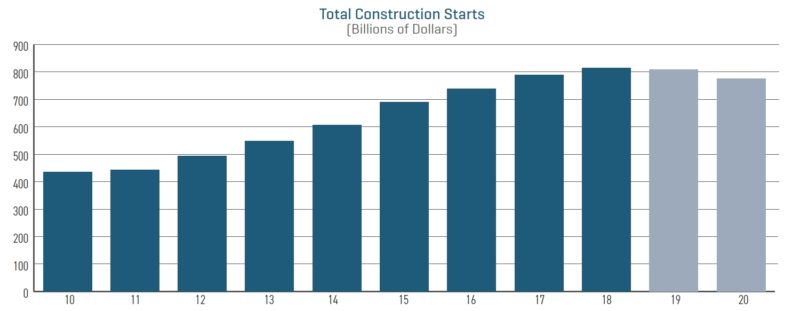

The U.S. economy and construction market have reached a tipping point. After a solid 10-year economic expansion and moderately healthy recovery in construction, total construction starts are now tipping over the edge into decline. According to Dodge Data & Analytics, total starts reached a peak at $815 billion in 2018 and will inch down 1% to $809 billion in 2019. With a potential economic storm (or at least some rain) gathering on the horizon, total construction starts are expected to decline a further 4% in 2020 to $776 billion.

Here’s a quick look at the highlights of the 2020 forecast:

- Single-family housing starts peaked in 2018 at 833,000 units ($230 billion), then headed 3% downward in 2019 and will drop another 5% in 2020 to a cyclical low of 765,000 units. The dollar value of single-family housing starts will slide 3% in 2020 to $217 billion after falling 3% in 2019. The single-family downturn will be mild since its recovery barely got off the ground.

- Multifamily housing starts reached a peak in 2018 at 542,000 units ($99.8 billion) and will drop 11% in 2019 and 15% in 2020 as starts fall to 410,000 units. In dollar terms, multifamily starts will slide 9% in 2019 followed by a 13% drop in 2020 to $78 billion. The multifamily downturn will be more definitive since the sector’s expansion was robust—even exceeding the previous 2005 peak.

- Commercial building starts are expected to peak in 2019 at $127 billion, although square footage peaked in 2017 at 770 million square feet (msf). In 2020, starts will slide a more pronounced 10% to 670 msf, and dollar value will fall 6% to $120 billion. Performance in commercial building has varied substantially by category— warehouses and hotels have performed exceptionally well, offices have increased moderately but stores and shopping centers have shown dismal outcomes.

Growth of Zero Energy Buildings

An important sustainability trend continues to increase in the next decade

By Alexi Miller, Senior Project Manager, National Buildings Institute

The buildings industry is changing fast. Tomorrow’s project flow may not look like it has in the past. The fast-growing awareness of the impending climate crisis is driving major policy and market changes across North America and around the world. Buildings account for about 40% of annual global greenhouse gas emissions. We cannot solve today’s most pressing climate challenges without addressing energy use and emissions in the buildings sector.

New Buildings Institute (NBI) has been tracking zero energy (ZE) buildings for more than a decade now. In the first Getting to Zero Status Update published by NBI in 2012, we proudly reported 60 commercial and multifamily buildings or projects that were either Verified by NBI as having achieved zero energy performance or were Emerging to that level. Today, our free, interactive Getting to Zero Buildings Database (newbuildings.org) maps more than 650 zero energy buildings across North America: that’s over 1000% growth in 10 years!

READ MORE

Complexity and Interconnectedness of Building Enclosure Components Drives Demand for Consultant Input

The construction team is expanding to meet increasingly more sophisticated projects

By Brian Pallasch, CAE, Executive Vice President & CEO, International Institute of Building Enclosure Consultants

For those involved in the construction industry, there can be no doubt that buildings are getting more sophisticated. From a desire to improve sustainability or energy efficiency, to the incorporation of high-tech controls, commercial buildings are increasingly complicated. And the systems that comprise the building are more numerous and interconnected. This complexity has driven a number of changes that will continue into the future.

A Need for Specialized Individuals on The Project Team: Consultants

Enclosure systems provide one or more functions for the building, such as assistance with thermal comfort, access to daylight, weatherproofing, structural load resistance, or aesthetics.

READ MORE

Investing in Innovation and Changing the Narrative

New technologies and trends are forcing firms to be responsive and adapt

By John Trifonoff, Vice President, East Coast Metal Systems

The decade may be new, but a major problem facing the construction industry is not: a skilled labor shortage. This has been a critical issue in our line of work for some time, and companies either must adjust their business model to work within these new circumstances or succumb to them. East Coast Metal Systems has acclimated to this situation by strategizing in these three key areas: technology, education and our staff.

Technology

Staying on top of industry technology and news is a key component to adapting to the labor shortage. With fewer people and tighter timelines, staying on top of industry technology and news is something that has yielded positive results.

READ MORE

Marketing Becomes Mission Critical for Construction Products and Services

Marketers plan to increase Activity going into 2020

By Neil Brown, Chairman, Construction Marketing Association

Each year, the Construction Marketing Association (CMA) conducts a national survey of marketers and executives in construction-related industries, from commercial contractors, to building products manufacturers. The results of the survey are presented at an annual marketing outlook webcast, with a corresponding report.

Beside the report, the webcast includes “New Year’s Marketing Resolutions,” which is a summary of trending marketing imperatives.

Following is a summary of survey results, along with 2020 marketing resolutions.

READ MORE