Coronavirus wreaks havoc on retail supply chains globally, even as China’s factories come back online

(A container ship berthing at the port in Qingdao, in China’s eastern Shandong province.)

At first, U.S. retailers were most concerned about manufacturing facilities being disrupted by COVID-19 in China, where the virus originated.

Now, in the midst of a global pandemic, this is a much bigger issue than China. While some manufacturing operations are getting back up and running, much of the rest of the world is in distress.

The coronavirus could deal a blow to companies already on the brink of going out of business. While it may seem far off, the disruption is already starting to impact the shipment of goods to retailers for the back-to-school season, analysts say. And if the situation persists, it could end up hitting the holidays, when many retailers make the bulk of their profits.

“In 25 years, I have never seen anything like this,” parcel managing and logistics platform ShipMatrix President Satish Jindel said. “There is a psychological element, which is very hard to predict. … This is an unprecedented situation.”

Parcel volume fell 2.4% among manufacturing customers in February 2020 compared with a year ago, according to data pulled by ShipMatrix. Health-care parcel volume dropped 2.2%, it said. And parcel volume was down 1.8% in the automotive and auto-parts sector.

COVID-19 first emerged in Wuhan, China on Dec. 31. By the end of January, the region was sliding into isolation. Wuhan, a city of 11 million and the capital of central Hubei province, virtually went into lockdown, with nearly all flights at Wuhan’s airport canceled and checkpoints blocking the main roads leading out of town.

The virus has since spread into the U.S., Canada, Italy, Spain, France, South Korea, Iran and Germany, among other countries. There have been more than 179,000 cases confirmed globally, and at least 7,057 deaths, according to the latest data from Johns Hopkins University.

It was declared a pandemic by the World Health Organization on Wednesday. The U.S. declared a national emergency on Friday. Retailers are faced with the reality that there will be supply chain implications, beyond just sourcing and production in China. And some will be more prepared to weather the storm than others.

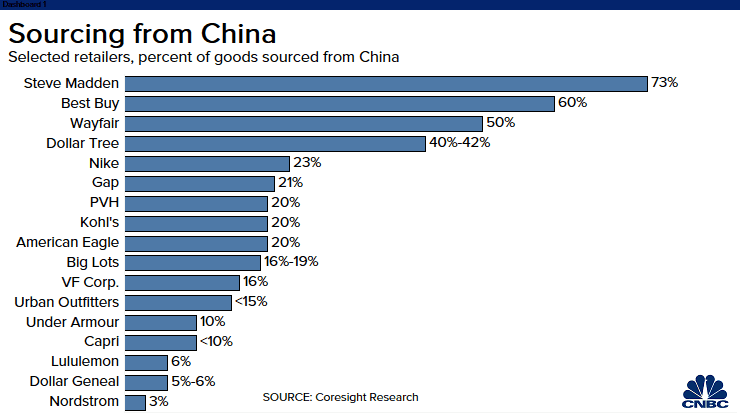

Still, one cannot ignore the role China plays, by itself, in so many businesses getting goods onto shelves. Overall, roughly 20% of U.S. retailers’ supply chains are exposed to China, according to data pulled by Cowen & Co.

Shoemaker Steve Madden, with some of the biggest exposure, has said about 73% of its goods are sourced from China. For Best Buy, it is 60%. For online furniture company Wayfair, it is about 50% of goods. Each American Eagle, Kohl’s and Calvin Klein owner PVH source about 20% of goods from China.

The shoe industry is seen as one of the most reliant. Seventy percent of footwear sold in the U.S. comes from China today.

Imports of footwear to the U.S. from China fell the most this January in more than a decade. A 15.7% drop was also the worst fall year over year in four years, said Matt Priest, Footwear Distributors and Retailers of America president and CEO.

“The challenge is a lot of raw materials come from China,” Priest said. “This is not unique just to our industry.”

Athletic apparel maker Under Armour on Feb. 11 said it was “reasonable to expect industry-wide delays in terms of delivery around the world — including potentially missed shipment[s] and service windows.”

Then, Macy’s on Feb. 25 said it was planning for a coronavirus hit but that the virus was “nothing to be concerned about yet.”

But as time has dragged on, and COVID-19 has hit other parts of the globe beyond China, the messages have evolved, and seemingly intensified. Gap said Thursday that it was “not currently possible” to quantify the hit it will take in 2020 from the coronavirus. But the company said it faces a “period of uncertainty regarding the potential impact on both … supply chain and customer demand.”

Apparel retailer Abercrombie & Fitch on Sunday warned the situation would have a “material adverse” impact on its financial performance. It withdrew its earnings forecast. And it likely won’t be the last retailer to offer up such a warning.

At least $700 million in losses

Losses for U.S. retailers — from production and transportation shortages due to coronavirus — could amount to $700 million from March 9 to April 20, according to data pulled from logistics start-up Zencargo.

“Our clients cannot anticipate how big this disruption will be,” Andy Postal, managing partner of investment bank MMG Advisors, said in an interview.

If there is any good news, it is that things are coming back online in China, and people are returning to work, as the pace of reported coronavirus cases slows in the region. Now, Europe has become the new epicenter of the COVID-19 pandemic, WHO officials said Friday.

“In the last week, pretty much all the factories [in China] are operational again,” Walter Kemmsies, managing director and economist for commercial real estate services firm JLL’s U.S. Ports, Airports and Global Infrastructure group, said in an interview on Thursday. “The problem is they are only at 50% to 75% capacity. … The problem is [getting] truck drivers.”

The retail industry’s leading trade group says there are still supply chain complications to work through, and things will likely be worse before they are better.

U.S. ports handled 1.82 million twenty-foot equivalent units (or TEU) in January, up 5.7% from December but down 3.8% from a year earlier, according to the Global Port Tracker report released earlier this month by the National Retail Federation and Hackett Associates. A TEU is defined as one 20-foot-long cargo container, or something equivalent.

February has been estimated at 1.42 million TEU, down 12.6% from a year prior and significantly down from the 1.54 million TEU forecast before the coronavirus began to take its toll, NRF said. March is forecast at 1.32 million TEU, down 18.3% from last year and falling short of the 1.7 million TEU anticipated before the virus.

“There are still issues affecting cargo movement, including the availability of truck drivers to move cargo to Chinese ports,” Jon Gold, NRF vice president for Supply Chain, said. “Retailers are working with both their suppliers and transportation providers to find paths forward to minimize disruption.”

Similar to how a trade war accelerated the rate at which some retailers were trying to lessen their reliance on China as a manufacturing hub, COVID-19 could accelerate more diversified supply chains, experts have told CNBC.

It could again accelerate the rate at which companies try to move business out of China, for example. It could also motivate companies to look for ways to make their supply chains more digital. As one example of this, an apparel manufacturer might try to create 3D samples of clothing online, instead of requiring trips back and forth overseas — between the buyer and the manufacturer — to see those samples in person.

With a situation so fluid, the big question left on the table is timing.

Retailers are typically starting to ship in goods for the holiday from Asia as early as May and June, ShipMatrix’s Jindel said. They are currently preparing orders for the back-to-school season.

“We already know April will be screwed up. … The disruption, if it really starts to have a serious effect on business, could make a material adverse effect on a very critical holiday shopping season,” he said.