See Also Pandemic Impact on Construction – Recession in 2020 3-20-20

See Also Pandemic Impact on Construction – Part 2 3-31-20

See Also Pandemic Impact #4 – Construction Jobs Recovery 4-15-20

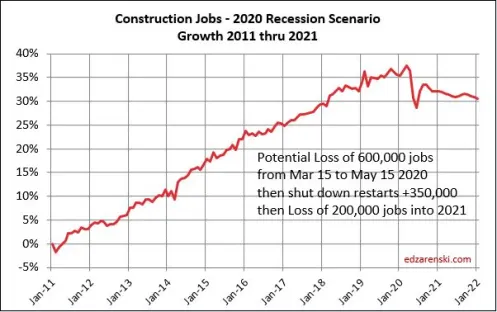

Today, with the unemployment claims report, we get an indication of the 3rd out of 4 weeks of the total April monthly jobs report. When the April jobs report is released on May 8th, it will cover the period March 15 through April 12. For the first two weeks, there were 10 million new unemployment claims and within that data, the Economic Policy Institute estimated there were 310,000 construction jobs lost. Today’s report show the three-week total is now 16 million claims. That could potentially indicate a total 500,000 construction jobs lost in three weeks, and that represents only 3/4ths of the April jobs report. There are still areas of the country that are just beginning to issue stay-at-home orders, so this trend will likely continue next week. When we see the next jobs report May 8th, we could see a total monthly loss of more than 600,000 construction jobs, a loss of more than 8% of the workforce. In the worst months of the 2008-2009 recession it took 5 months to lose over 600,000 jobs.

See Pandemic Impact #7 for an update on Jobs Lost

History dating back 30 years shows that construction companies have always reduced jobs by less than the reduction in work volume lost. In the previous recession, work volume fell by 50% but jobs declined by only 35%. In other words, companies tend to retain more staff than the remaining workload will support. As a result, work put in place per job, a simple measure of productivity, goes down. This drives cost up.

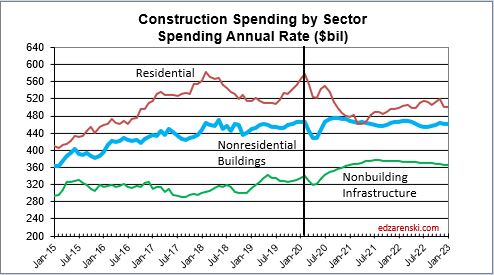

Given the above, we can estimate the amount of construction volume lost between March and April could be on the order of 10% to 12%. We won’t see April construction spending #s until June 1st, but a loss of 10% equates to about $10-$12 billion work stopped in a single month. After four months averaging above a seasonally adjusted annual rate (SAAR) of $1.360 trillion, we could see March SAAR spending drop to $1.320 trillion and April down to $$1.280 trillion.

Pandemic Construction Forecasting needs to account for 4 types of impacts.

- 1 Work stoppage – stay at home, how deep is the work stoppage

- 2 Work restart – % restart/month, how slow does work restart

- 3 Work canceled – some work never restarts, how severe

- 4 New Starts – future capital spending plans canceled, how cautious

The initial Pandemic Recession Scenario developed in my 3-20-20 article included a greater reduction in new starts, but did not factor in the widespread shutdown of commerce in March-April. This plot shows the shutdown, the big dip in the first half of 2020. The initial shutdown cumulative total spending (deepest) low point is in April-May 2020 due to the shut down which then rebounds with the restart of most, but not all, work. Then the cumulative total spending low point due to reduced new starts occurs in the first half of 2021, where residential spending hits it’s low point.

Will Construction Experience Inflation or Deflation?

Although as of yet there is no solid information available on materials pricing or national reports on inflation, these issues may come up;

There is a cost to temporarily shutting down a job and then re-mobilizing. That cost definitely was not included in any budgets on any projects. That cost, already incurred, will be absorbed into the final cost of projects, inflating the original projected cost. That will become a factor adding to 2020 inflation.

Some analysts are suggesting there will be a large surplus of materials that will drive cost down. However, there are reports cautioning to expect shortages or long delays of materials due to the fact that some manufacturers have experienced the same shut downs as the industries that use their products. Production of all types of products has slowed with the lack of workforce. One recent article cited expectations of many shortages of electronic, mechanical and technology components, a large volume of which are imported. So there may be difficulties in getting components of electrical, plumbing, mechanical, controls or technology products needed to complete manufacturing of the products needed on jobs in the near future.

Worldwide shipping and moving of all types of products that arrive in shipping containers has been drastically disrupted. By Mar 1 shipping at the Port of Los Angeles was already down 25%. This will cause delays in imported product deliveries which will either result in the need to use alternate products, time extension to completion or need for accelerated schedule.

There will be some difficulty associated with staffing back up to previous levels. As workers are cut from jobs, some will immediately begin to seek other available work with some potentially leaving the construction industry permanently. Although wage negotiations may be held in check, some contractors may offer incentives to secure sufficient labor to support the completion of their projects, driving up the cost of labor. Also worker productivity will be reduced to accommodate new rules instituted to insure worker health safety and distancing.

The restart is going to cause bottlenecks. Every job will be requesting delivery of needed products at the same time. The supply-side system is not designed to handle that massive influx of all-at-the-same-time orders and deliveries. This will result in materials delivery delays and/or priority order added premiums.

Along with materials issues, we can expect once projects come back on-line, some owners are going to ask for accelerated schedules to meet critical end dates. Any move to accelerate project schedules will add cost to labor. In fact it could add considerable cost. If a project is shut down for two months and the owner asks to make up 1 month, it takes more than one month of overtime to accomplish that. All overtime, including second shift work, has some lost productivity associated with it, so you never get hour for hour production on overtime hours. If the owner wants to try to meet the original scheduled end date, or make up even some of the delay, all the cost of overtime and lost productivity inflates the original cost.

Management cost to see the projects through delay, ramp back up and finally reach completion, probably at a time extension, increases beyond the original proposed staffing and time on the job.

It will take several months, perhaps even the remainder of the year, to see a trend in new construction starts. Expect capital investment plans in new building projects to increase in some markets (i.e., healthcare) but to decline in others (hospitality). Many companies will experience dramatically reduced revenues and profits which will cause them to reassess plans for future capital investment. If capital investment declines overall, which I expect it will, the amount of construction activity next year will decline. Early discussions of infrastructure investment, if increased investment comes to be reality, could change this outcome. Markets could be a bit more competitive next year if the volume of work out for bid declines. That would have a tendency to offset some of the inflationary measures listed above.

Dodge Data & Analytics on 4-9-20 released their first indications of recession analysis. Dodge predicts a 10% to 15% decline in new construction starts in 2020, but then an increase in all sectors in 2021. Dodge tracks new starts only, so does not project the spending impact of a decline in starts or of project delays.

Repeating what I stated in a previous article, What all this will do to the construction inflation rate is hard to predict. If materials shortages or delivery delays develop, that would cause prices to increase. Also, many projects that were already under construction were halted for an undetermined period of time. The delays may add several weeks to a few months to the overall schedule. These issues all add cost to a project as describe above. Looking to the future, if new starts work volume decreases, then the bidding environment gets more competitive and prices go down. However, I think in this case the materials availability issues, potential labor availability, productivity and schedule delays will outweigh any decline in work available for bid. For the short term, I would suggest to add a minimum of 1% to all baseline inflation rates for 2020 and 2021. Further assessment of future bidding environment will be required.

The first hard data on construction jobs won’t be issued until May 8th when we will get mid-March to mid-April jobs, and not until June 1st for April construction spending activity. April activity will be revised to a better number on July 1st. So the construction industry is really at a disadvantage not knowing the real impacts for several months.