N.Y. metro area (including North Jersey) named No. 1 market for commercial/multifamily construction starts

(- Dodge Data & Analytics)

The New York Metropolitan area, which includes northern New Jersey, was named the top market market out of 20 for commercial and multifamily starts by Hamilton-based Dodge Data & Analytics, a Hamlton-based provider of software and analytics for the construction industry.

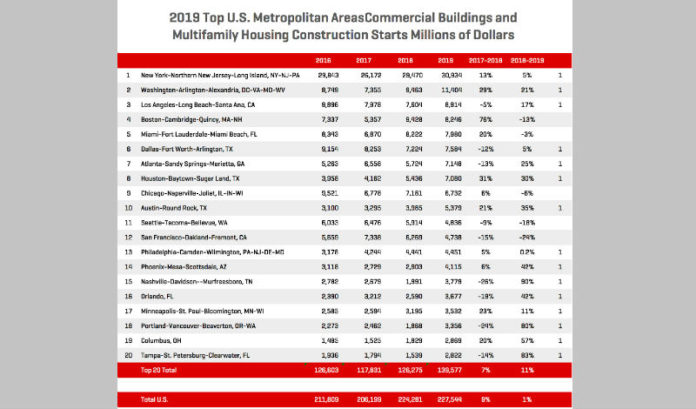

The total value of commercial and multifamily construction starts in the Top 20 U.S. metropolitan areas gained 11% in 2019, reaching $139.6 billion. Nationally, commercial and multifamily starts were up 1% in 2019 to $227.5 billion.

“Commercial construction starts continue to be the bulwark of U.S. construction activity as strong demand for office and warehouse buildings pushes the value of construction to higher levels,” Richard Branch, chief economist for Dodge Data & Analytics, said.

Here’s the Top 10:

- New York-Northern New Jersey-Long Island: $30.9 billion;

- Washington-Arlington-Alexandria: $11.4 billion;

- Los Angeles-Long Beach-Santa Ana: $8.9 billion;

- Boston-Cambridge-Quincy: $8.2 billion;

- Miami-Fort Lauderdale-Miami Beach: $8 billion;

- Dallas-Fort Worth-Arlington: $7.6 billion;

- Atlanta-Sandy Springs-Marietta: $7.1 billion;

- Houston-Baytown-Sugar Land: $7 billion;

- Chicago-Naperville-Joliet: $6.7 billion;

- Austin-Round Rock: $5.4 billion.

Each of the Top 10 metropolitan areas gained 8% over the year, with seven of the 10 reporting year-over-year gains.

The New York metro area was the largest market for commercial and multifamily starts at $30.9 billion. The area’s rate of growth in 2019 eased up to 5% from 13% in 2018. Washington D.C. held onto second place in 2019, with an 18% gain to $11.4 billion, followed by Los Angeles metro (up 17% to $8.9 billion). Other Top 10 markets with gains included Dallas (up 5% to $7.6 billion), Atlanta (up 25% to $7.1 billion), Houston (up 30% to $7.1 billion) and Austin (up 35% to $5.4 billion). Those that saw declines include Boston, Miami and Chicago.

Together, the Top 10 accounted for 45% of all U.S. commercial and multifamily constructions starts in 2019, up from 42% in 2018.

“For 2020 multifamily construction starts are likely to continue lower as the declines broaden to more and more metropolitan areas. Meanwhile commercial starts have posted gains for nine consecutive years, but a slowing economy in 2020 will likely lead to fewer large value projects, causing national starts to pull back from their 2019 level,” Branch said.

Here’s the Top 11-20:

11. Seattle-Tacoma-Bellevue;

12. San Francisco-Oakland-Fremont;

13. Philadelphia-Camden-Wilmington;

14. Phoenix-Mesa-Scottsdale;

15. Nashville-Davidson-Murfreesboro;

16. Orlando;

17. Minneapolis-St. Paul-Bloomington;

18. Portland-Vancouver-Beaverton;

19. Columbus;

20. Tampa-St. Petersburg-Clearwater.

In the second tier of metro areas, ranked 11-20, gains were seen in seven of them, including Philadelphia, up less than 1% ($4.5 billion), Phoenix (up 42% to $4.1 billion), Nashville (up 90% to $3.8 billion) and Orlando (up 42% to $3.7 billion). Two markets showed declines: San Francisco (down 24% to $4.7 billion) and Seattle (down 18% to $4.8 billion). The 10 second-tier areas accounted for 17% of all U.S. commercial building and multifamily starts, up from 15% in 2018.

“Multifamily starts, however, are past their peak and have entered cyclical decline. The growing divide however between the larger and smaller metro areas was stark in 2019. While commercial and multifamily starts in the top 20 metro areas in the country moved 11% higher in 2019, those metros ranked 21-50 lost 7%,” Branch said.