While there are several risks facing the U.S. economy and the construction sector in 2023, the most pressing concern is the ongoing battle over raising the debt ceiling, which could have significant repercussions for government spending and overall economic stability.

In the second quarter edition of the Construction Market Forecasting Service (CMFS) released in May 2023, it was assumed that the U.S. economy would barely avoid recession in 2023 thanks to the strength in the labor market and the debt ceiling would be raised before the X date (the date at which the government could no longer pay its bills), which as of writing is projected to be in early June.

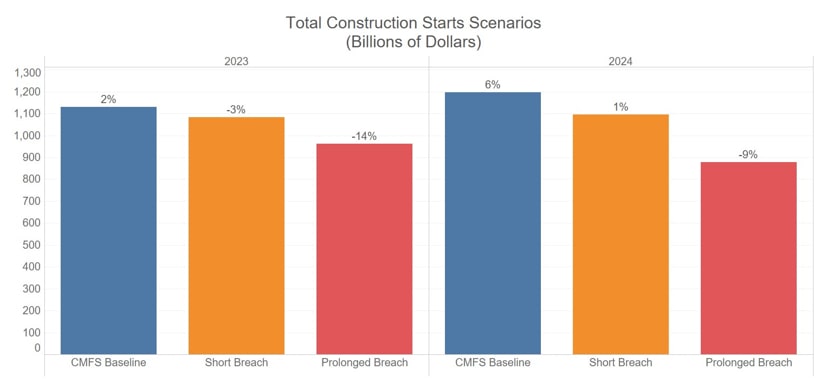

Under this scenario, construction starts would muddle through 2023, rising 2% from the previous year. Private markets (residential, office, hotel, warehouse, etc.) would feel pressure while public markets (infrastructure, education, healthcare) would offset the negativity. Manufacturing, and the inclusion of the CHIPs and Inflation Reduction Act (IRA) monies, have transitioned this sector into a quasi-public sector (for the short-term at least), and as such it will also lend support to the industry in 2023.

But what if the debt ceiling assumption didn’t pan out and the U.S. breached?

Moody’s Analytics recently published two debt ceiling breach scenarios:

Short Breach: The debt limit is breached in early June, but Congress resolves the crisis a week after the breach. The U.S. enters a brief recession.

Prolonged Breach: The debt limit is breached in early June and lawmakers don’t solve the issue until the end of July. This deals a blow to the U.S. economy and triggers a deeper recession.

The Dodge Construction Network Economics Group ran these two alternative scenarios through our econometric construction starts models to get a sense of how construction starts would react.

Under the short breach scenario, total construction starts would go from climbing 2% in 2023 to falling 3%, and barely expanding in 2024. In many ways, this scenario is fairly similar to the baseline, albeit with greater amplitude for the individual verticals. Residential and commercial (retail, warehouse, office, hotel) starts would fall into deeper holes in 2023 and remain negative in 2024. Since the breach is short, public markets will continue to be supported by funds from IIJA, CHIPs, and IRA although the second and third quarters of 2023 would see weakness.

The much more somber scenario is the prolonged breach. Under this scenario, construction starts would fall 14% in 2023 (compared to +2% in the baseline) and fall a further 9% in 2024. In many ways, this is akin to the impact of the financial crisis on starts in the 2007-2009 period.

Much like the financial crisis, all verticals – even those buoyed by IIJA, CHIPs, and IRA – would suffer in 2023 and 2024. From peak to trough, total construction starts would lose roughly 30%. This is more “mild” relative to the 40% peak-to-trough decline in 2007-2009 as it is assumed that IIJA, CHIPs, and IRA funds would begin to slowly flow back into the market in Q4 of 2023.

While the comparison to the Great Recession is convenient, this is where it ends. Unlike the 2007-2009 period, there are no significant systemic issues facing the economy – there are no asset bubbles, banks are well capitalized etc. Inflation is a problem, but the Fed is slowly winning the battle. This will translate into a healthy recovery in construction starts by late 2024 in the prolonged breach scenario and early 2024 in the short breach scenario.

While these two scenarios seem unlikely to occur, it is safe to assume that brinksmanship in Washington will take raising the debt ceiling down to the wire. Considering that, it would seem prudent to hope for the best, but prepare for the worst.