Despite economic woes and bank failures, construction shows strength across Q1

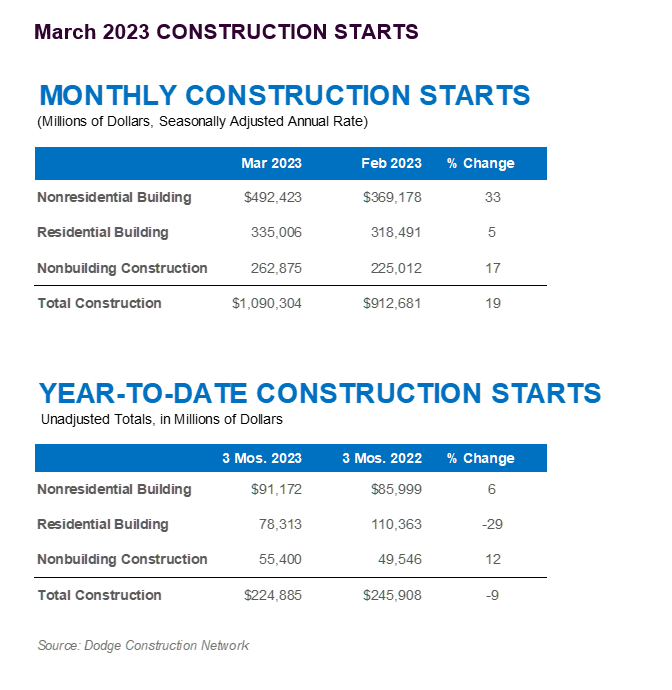

HAMILTON, NJ —April 20, 2023 — Total construction starts increased 19% in March to a seasonally adjusted annual rate of $1.09 trillion, according to Dodge Construction Network. During the month, nonresidential starts rose 33%, nonbuilding starts increased 17%, and residential starts moved 5% higher.

In Q1 of 2023, total construction starts were 9% below that of 2022. Year-to-date, residential starts were down 29%, nonresidential and nonbuilding starts grew 6% and 12% respectively. For the 12 months ending March 2023, total construction starts were 11% higher than the 12 months ending March 2022. Nonresidential and nonbuilding starts were 33% and 21% higher, respectively, while residential starts lost 11%.

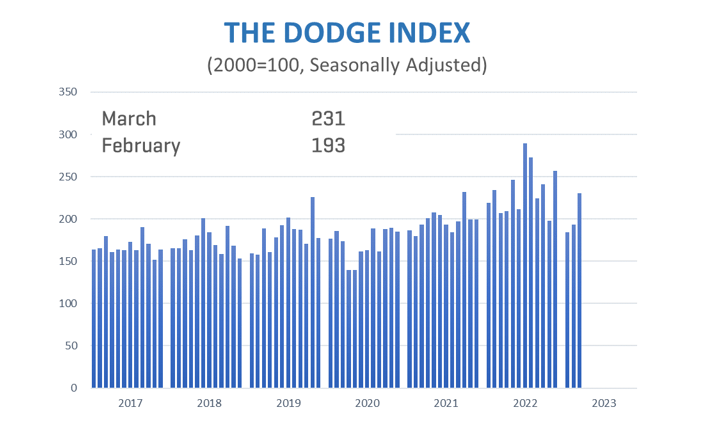

“Construction starts activity has yet to see the impact of tightening financial conditions in the wake of the failure of Silicon Valley and Signature Banks,” said Richard Branch, chief economist for Dodge Construction Network. “Several large manufacturing projects are breaking ground; pushing nonresidential buildings higher, while a nascent recovery in single family starts has been supporting residential growth. Construction starts began the year with gusto, but that is likely to erode as the year progresses, as seen by the declining trend in the Dodge Momentum Index, which tracks projects entering the earliest stages of planning.”

· Nonbuilding construction starts gained 17% in March to a seasonally adjusted annual rate of $263 billion. Miscellaneous nonbuilding was the only category to post a month-over-month loss. Environmental public works rose 35%, utility/gas plants gained 16%, and highway and bridge starts were up 13%. Year-to-date across Q1, nonbuilding starts gained 12%. Miscellaneous nonbuilding starts were up 43%, environmental public works rose 22%, utility/gas plants moved 8% higher, while highway and bridge starts gained 1%.

For the 12 months ending March 2023, total nonbuilding starts were 21% higher than the 12 months ending March 2022. Utility/gas plant starts rose 32%, and highway bridge starts increased 16%. Environmental public works and miscellaneous nonbuilding starts were up 20% and 23%, respectively, on a 12-month rolling sum basis.

The largest nonbuilding projects to break ground in March were the $606 million I-35 Capital Express North Lanes in Austin, Texas, the $445 million Klamath River Renewal Project, in Oregon, which involves the removal of hydroelectric dams, and the $375 million 360 MW Atrisco Solar Farm in Rio Rancho, New Mexico.

● Nonresidential building starts increased 33% in March to a seasonally adjusted annual rate of $492 billion. Manufacturing starts more than doubled over the month and once again were the driving force behind the gain as three very large projects got underway. Without these projects, total nonresidential starts would have only gained 3%. Commercial starts rose 28%, with retail as the only category to fall, while institutional starts improved 11% due to numerous healthcare projects getting underway. On a year-to-date basis through three months, total nonresidential starts were 6% higher than the first three months of 2022. Institutional starts gained 21%, manufacturing starts were 1% higher, while commercial starts were down 5%.

For the 12 months ending March 2023, total nonresidential building starts were 33% higher than the 12 months ending March 2022. Manufacturing starts were 122% higher, institutional starts improved 22%, and commercial starts gained 18%.

The largest nonresidential building projects to break ground in March were the $5.5 billion Hyundai EV plant in Ellabell, Georgia, the $3.0 billion Panasonic Energy North America Battery Manufacturing Plant, and the $780 million third phase of the BASF MDI chemical plant in Geismar, Louisiana.

● Residential building starts increased 5% in March to a seasonally adjusted annual rate of $335 billion. Single family starts rose 4%, and multifamily starts increased 8%. On a year-to-date basis through three months, total residential starts were down 29%; single family starts were 37% lower, while multifamily starts were down 12%.

For the 12 months ending in March 2023, residential starts were 11% lower than the 12 months ending in March 2022. Single family starts were 23% lower, while multifamily starts were up 16% on a rolling 12-month basis.

The largest multifamily structures to break ground in March were a $400 million mixed-use project in Jamaica, New York, the $225 million Chestnut Commons Affordable Housing project in Cypress Hills, New York, and the $268 million Knox mixed-use development in Dallas, Texas.

Regionally, total construction starts in March rose in all five regions.

Watch Chief Economist Richard Branch discuss March Construction Starts.