Large utility project, residential starts power growth to begin Q3

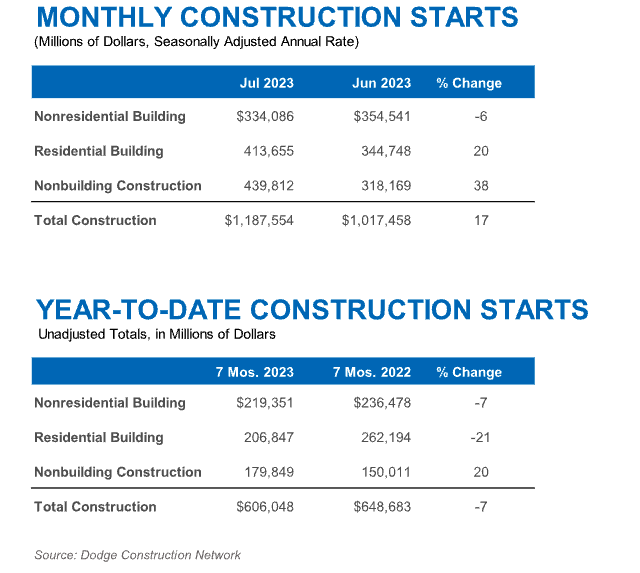

HAMILTON, NJ —August 16, 2023 — Total construction starts rose 17% in July to a seasonally adjusted annual rate of $1.2 trillion, according to Dodge Construction Network. Nonbuilding starts drove the increase, rising 38%, due to the start of a singular large LNG facility. Residential starts rose 20%, while nonresidential building starts lost 6%.

Year-to-date through July 2023, total construction starts were 7% below that of 2022. Residential and nonresidential starts were down 21% and 7% respectively; however, nonbuilding starts were up 20% on a year-to-date basis. For the 12 months ending July 2023, total construction starts were 3% higher than that of 2022. Nonbuilding starts were 21% higher, and nonresidential building starts gained 16%. Conversely, on a 12-month rolling basis, residential starts posted a 17% decline overall.

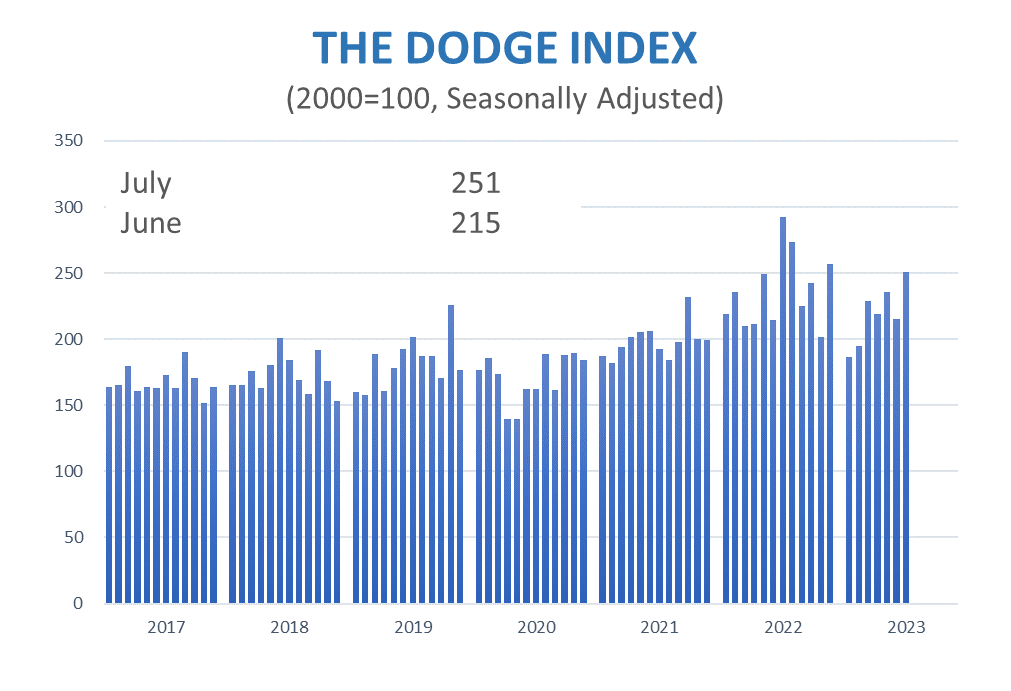

“Construction starts have plateaued and are making little headway,” said Richard Branch, chief economist for Dodge Construction Network. “Higher interest rates, labor shortages and material prices continue to impact the flow of construction starts — resulting in little forward momentum over the last 12 months. The lag in nonresidential building projects entering the planning stage will slow starts as the year progresses, which should be offset by rising infrastructure activity.”

Nonbuilding

Nonbuilding construction starts surged in July, climbing 38% to a seasonally adjusted annual rate of $440 billion, due mostly to the start of a large LNG facility. Without the mentioned facility included, total nonbuilding starts would have dropped 7%. Environmental public works also rose dramatically, increasing 62% due to the start of a large dock facility. Highway and bridge starts lost 4% in the month. Miscellaneous nonbuilding starts fell 71% following the start of the Buffalo Bills’ new stadium in June. Year-to-date through July, nonbuilding starts gained 20%. Utility/gas plants rose 23%, and miscellaneous nonbuilding starts were up 37%. Highway and bridge starts gained 14%, along with environmental public works rising 19%.

For the 12 months ending July 2023, total nonbuilding starts were 21% higher than the 12 months ending July 2022. Utility/gas plant and miscellaneous nonbuilding starts rose 9% and 32%, respectively. Highway and bridge starts were up 22%, and environmental public works rose 25% on a 12-month rolling sum basis.

The largest nonbuilding projects to break ground in July were the $12 billion first phase of the Rio Grande LNG facility in Brownsville, Texas, a $2.8 billion concrete dock at the Pearl Harbor Naval Shipyard in Hawaii, and the $813 million first phase of the Bellefield Solar farm and battery facility in California City, California .

Nonresidential

Nonresidential building starts fell 6% in July to a seasonally adjusted annual rate of $334 billion. Commercial starts rose 11% on the back of gains in warehouse and parking starts, offsetting a decline in office and hotel starts. Institutional starts were down 11%, with education, dormitories, and religious the only categories to show an increase. Manufacturing starts dropped 39% in July. On a year-to-date basis through July, total nonresidential starts were 7% lower than that of 2022. Institutional starts gained 8%, while manufacturing and commercial starts fell 9% and 31%, respectively.

For the 12 months ending July 2023, total nonresidential building starts were 16% higher than that ending July 2022. Manufacturing starts were 24% higher. Institutional starts improved 20%, and commercial starts gained 8%.

The largest nonresidential building projects to break ground in July were the $405 million Envision AESC BMW components manufacturing plant in Florence, South Carolina, the $370 million Wisteria at Warner Center office building in Los Angeles, California, and the $277 million first phase of an airside concourse at Orlando International Airport in Florida.

Residential

Residential building starts rose 20% in July to a seasonally adjusted annual rate of $414 billion. Single family starts gained 2%, while multifamily starts shot 62% higher. On a year-to-date basis through July 2023, total residential starts were down 21%. Single family starts were 25% lower, and multifamily starts were down 14%.

For the 12 months ending in July 2023, residential starts were 17% lower than in 2022. Single family starts were 25% lower, while multifamily starts were down only 0.1% on a rolling 12-month basis.

The largest multifamily structures to break ground in July were the $1 billion Clarkson Square condo and apartment building in New York City, the $365 million Queensbridge Collective residential tower in Charlotte, North Carolina, and the $358 million Oasis Hallandale tower in Hallandale Beach, Florida.

Regionally, total construction starts in July rose in the South Atlantic, South Central, and West regions but fell in the Northeast and Midwest.

Watch Chief Economist Richard Branch discuss July Construction Starts here.

July 2023 CONSTRUCTION STARTS